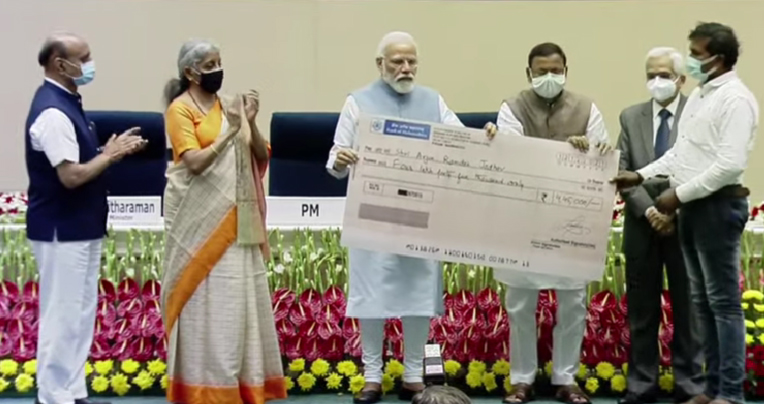

Prime Minister Shri Narendra Modi addressed a function on “Depositors First: Guaranteed Time-bound Deposit Insurance Payment up to Rs. 5 Lakh” in New Delhi on Sunday. Union Finance Minister MoS Finance and RBI Governor were among those present on the occasion. The Prime Minister also handed over cheques to some of the depositors.

The country is witnessing how a big problem which was going on for decades has been solved. He stressed that the spirit of ‘Depositors First’ is very meaningful. In the last few days, more than one lakh depositors have got their money back that was stuck for years. This amount is more than Rs 1300 crore, Shri Modi said.

“Understanding the concern of the poor and middle class, we increased the insured amount to Rs 5 lakh. Another problem was tackled by amending the law by making it mandatory that the depositors should get money within 90 days i.e. 3 months. That is, even in the event of a bank sinking, the depositors will get their money back within 90 days”, he said.

The Prime Minister noted that over the years, by merging many small public sector banks with large banks, their capacity, capability and transparency have been strengthened in every way. When RBI monitors co-operative banks, it increases the confidence of the common depositor in them, he said.

The Prime Minister said the problem was not only about the bank account, but also about the delivery of banking services to the remotest villages. Today, in almost every village of the country, the facility of a bank branch or a banking correspondent has reached within a radius of 5 km.

Lauding the digital progress achieved in the country, Modi said “When even the developed countries of the world were struggling to provide help to their citizens, India provided direct help to almost every section of the country at a fast pace”, he added.

The Prime Minister said banking had not reached women of the country in any significant way earlier. He said this was taken as a priority by his government. Of the crores of bank accounts opened under Jan Dhan Yojana, more than half belong to women. “The effect these bank accounts have on the economic empowerment of women, we have also seen in the recent National Family Health Survey”, he said.

Eight Union Ministers joined the event from across India– Nitin Gadkari from Mumbai, Piyush Goyal from Pune, Purshottam Rupala from Thane, among others

The Ministers interacted with invited beneficiaries of Deposit Insurance scheme at their respective venues and also distributed refund cheques.