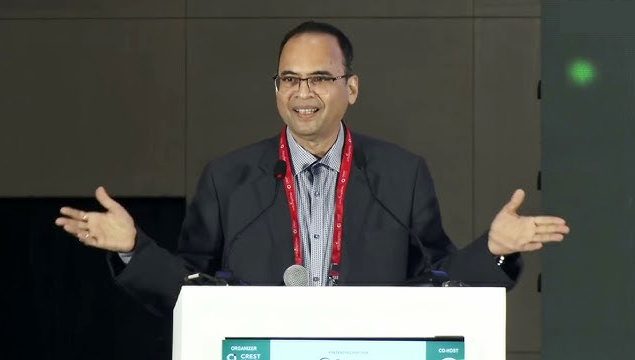

Governance problems, not market challenges, are the main reason behind the repeated crises in Urban Cooperative Banks (UCBs), said Vishram Dixit, CEO of Nashik Merchants Cooperative Bank. He called for a “governance renaissance” to bring back strength and trust in the cooperative banking sector.

Dixit said that though UCBs serve more than 8 crore customers and hold about 5% of India’s total banking business, many of them still struggle with weak management, poor compliance, and lack of skilled staff. “Governance and compliance are not obstacles-they actually help banks grow and build trust,” he said.

Referring to RBI data for FY 2024–25, Dixit noted that UCBs faced the highest number of penalties among all regulated banks. Most issues, he said, were due to weak risk assessment, Board interference in daily operations, and poor audit systems. “Boards should focus on policy and direction, not day-to-day decisions,” he added.

He also pointed out gaps like shortage of trained executives, limited use of technology, and short-term planning. These, he said, stop UCBs from becoming modern and efficient institutions.

Dixit urged cooperative banks to improve their internal audits, invest in digital tools, and build a strong compliance culture. “Good governance is not a burden-it is the path to progress,” he concluded, stressing that professionalism and transparency are key for the future of UCBs.