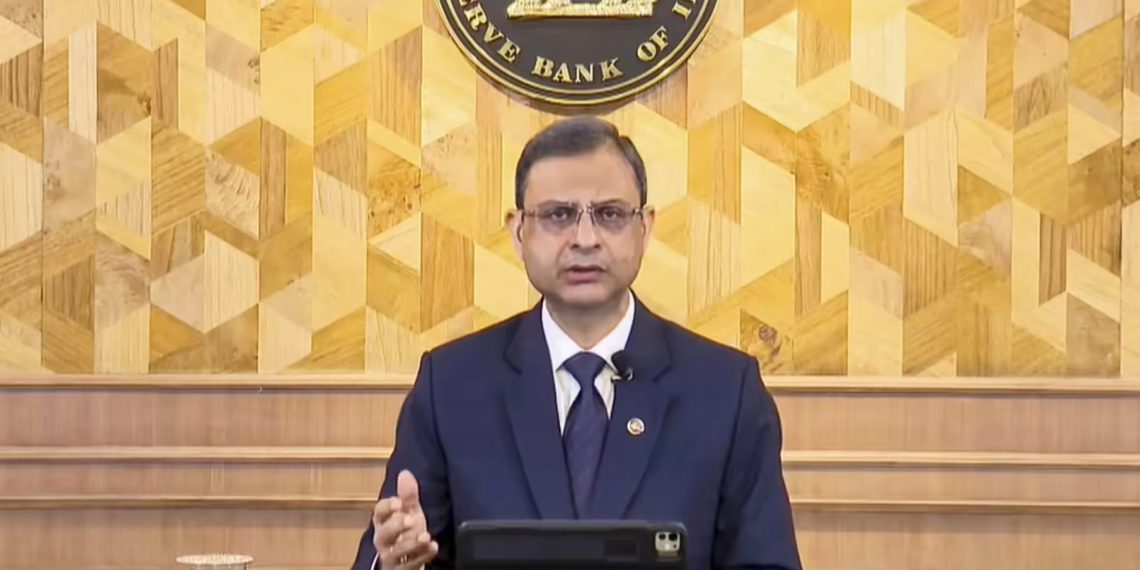

The Reserve Bank of India (RBI) has unveiled two landmark proposals with far-reaching implications for the cooperative banking sector. Delivering the Monetary Policy Statement on Wednesday, RBI Governor Sanjay Malhotra announced that the central bank will re-examine the licensing framework for Urban Co-operative Banks (UCBs) after a gap of over two decades.

Licensing for new UCBs has been on pause since 2004 owing to supervisory and governance concerns. However, citing “positive developments in the sector” and growing demand from stakeholders, Governor Malhotra revealed that the RBI will shortly publish a discussion paper on licensing of new UCBs.

Observers believe that the proposed paper is likely to seek inputs from experts, cooperators, and the wider financial community on ways to reintroduce new players into the cooperative banking landscape, while ensuring robust oversight and sustainable operations.

Alongside this, the RBI has also announced a major consumer-centric reform by expanding the ambit of its grievance redressal system. The Integrated Ombudsman Scheme (RB-IOS), which currently covers commercial banks, NBFCs and select financial entities, will now be revamped and extended to include rural cooperative banks.

This means District Central Cooperative Banks (DCCBs) and State Cooperative Banks (StCBs) will come under the direct ambit of the RBI’s ombudsman mechanism for the first time.

By doing so, the central bank aims to ensure that cooperative depositors and borrowers, particularly in rural areas, have access to a transparent, independent, and effective forum for grievance redressal.

This marks a significant step towards improving customer trust and accountability in cooperative institutions, many of which serve as the financial backbone for farmers, rural entrepreneurs, and small borrowers.

Together, the two developments, opening the door for new UCBs and strengthening consumer protection in rural cooperative banks, represent a decisive push by the RBI to modernize the cooperative banking framework.

The proposals are expected to not only expand the sector’s reach but also raise governance and service standards, ensuring cooperatives continue to play a central role in India’s inclusive growth journey.