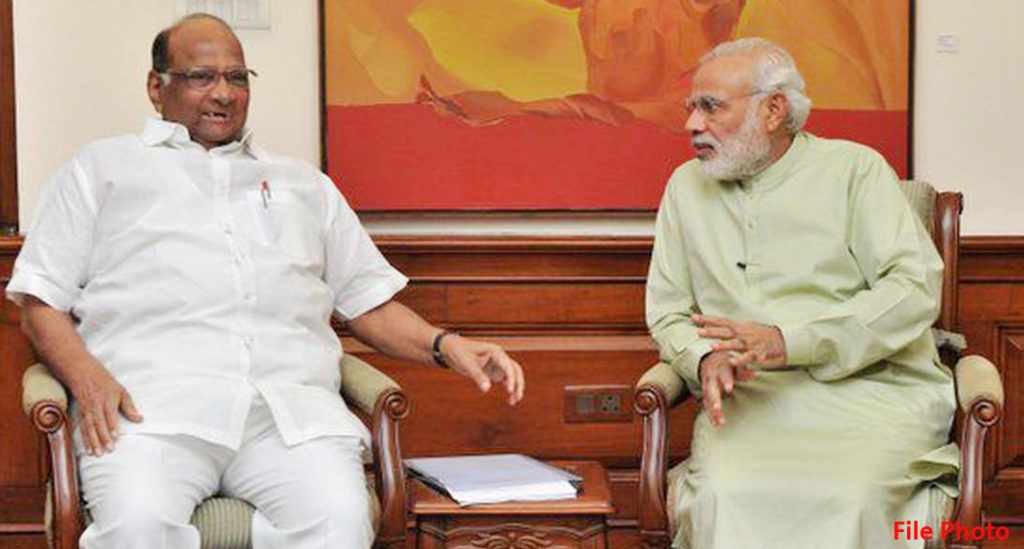

Congratulating Prime Minister Narendra Modi for mentioning cooperatives from the pulpit of Red Fort, as was never done in the past by any PM, former Union Agriculture Minister Sharad Pawar did not miss to point out to the PM that the recent Ordinance on co-op banks is nothing short of privatization of the co-op sector.

Pawar was referring to Modi’s speech in which he said “Co-operative banks are brought under the supervision of the Reserve Bank from the point of view to protect the interest of the middle class.”

Writing a detailed letter (a copy of which is with Indian Cooperative) Pawar cautioned the PM saying “it is essential to bring in financial discipline in the Co-operative Banks, however at the same time I honestly feel that the existence of Co-operative Banks and their ‘Co-operative’ character shall be preserved.”

Complementing Modi for coming from a state(Gujarat) which boasts a vibrant co-op movement, Pawar frankly shared his opinion about the attitude of RBI towards co-op banks saying “Prima facie, with regret I would like to convey the ‘untouchable’ approach of the Reserve Bank, based on pure financial and commercial considerations towards the Co-operative Banking Sector.”

“The outlook of the Reserve bank is that the share of the Co-operative Banking Sector in the overall Banking Sector is merely about 3%. At present out of the 1544 Urban Co- operative Banks (UCBs) in the country, around 897 UCBs have a deposit base of less than 100 crore and 115 UCBs have a deposit base of less than 10 crore. Since these Banks do not have the latest technology and due to widespread network of their branches over a large geographical area, the Reserve Bank finds it practically impossible to conduct inspection of all UCBs every year and therefore insisting for conversion of Co-operative Banks into Private Banks”, writes Pawar.

Almost echoing MSCB’s Anaskar words Pawar writes “It is pertinent to mention here that the Reserve Bank since 1993 has been trying to convert UCBs into Private Banks by setting up various committees and issuing circulars from time to time to implement recommendations of these committees, but could not succeed.”

Pawar also said that conversion of Co-operative Sector into Private Sector would not prevent financial irregularities and quoted the figure of fraudulent transactions occurring in Nationalized banks.

Challenging the opinion that there is no professionalism in co-op banks, Pawar compared the data for NPAs of the two and said that co-ops are better off than their commercial cousins.

“I, therefore earnest requestly you to kindly look into the matter personally and give justice to the Co-operative Banking Sector having a legacy of more than 100 years and striving hard not only to exist but to grow despite all odds”, Pawar concluded.

The letter has tone and tenor very much similar to the one written earlier by Nafcub Vice President Vidyadhar Anaskar to its President calling the recent Ordinance a move to privatize the co-op banks.