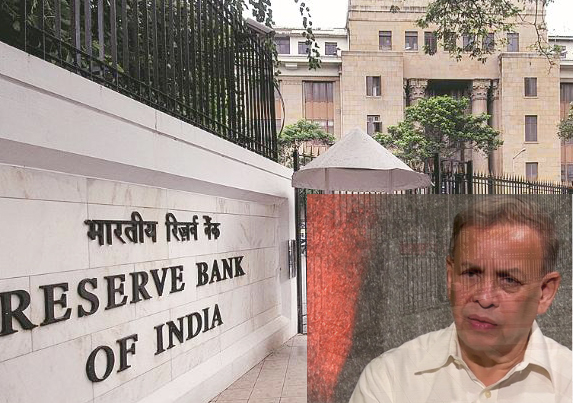

On the issue of creation of Investment Fluctuation Reserve (IFR) by Co-operative banks Sahakar Bharati patron Satsih Marathe has expressed his dissatisfaction and called for the same treatment to all UCBs as was extended to PSU & Pvt Sector Banks.

It bears recall that Department of Co-operative Bank Regulation of RBI wrote letters to the Chief Executive Officer of all Primary (Urban) Co-operative Banks, State Co-operative Banks and all District Central Co-operative Banks on the issue of Spreading of MTM losses and creation of Investment Fluctuation Reserve (IFR) by Co-operative banks.

The letter reads “With a view to addressing the systemic impact of sharp increase in the yields on Government Securities, it has been decided to grant UCBs which are not mandatorily required to create Investment Fluctuation Reserve (IFR) i.e. UCBs with aggregate DTL less than Rs. 100 crore as on March 31, 2017, the option to spread provisioning for mark to market (MTM) losses on investments held in AFS & HFT category for the quarters ended December 31, 2017, March 31, 2018 and June 30, 2018 only.

“The provisioning for each of these quarters may be spread equally over up to four quarters, commencing with the quarter in which the loss was incurred. It has also been decided to grant similar option to all StCBs / DCCBs in respect of investments held in Current category”, the letter says.

Marathe said “It falls short of the Sector’s expectations.” There is no relief for the bigger UCBs which really needed the support, he added.

Lamenting that once again it reflects that RBI remains biased towards the UCB Sector Marathe vowed to follow the matter and demanded parity between co-op sector and the PSU and private banks. “It is sad”, he said to Indian Cooperative.

Titled “Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks – Spreading of MTM losses and creation of Investment Fluctuation Reserve (IFR) by Co-operative banks”, RBI refers to circular on the subject in 2003 on ‘Guidelines for Investment Fluctuation Reserve’ issued to Primary (Urban) Cooperative Banks (UCBs), and another circular dated September 04, 1992 on the same subject.

“The provisioning for each of these quarters may be spread equally over up to four quarters, commencing with the quarter in which the loss was incurred. It has also been decidedto grant similar option to all StCBs / DCCBs in respect of investments held in Current category”, the letter reads further.

All eligible co-operative banks that utilize the above option shall make suitable disclosures in their notes to accounts providing details of the provisions for depreciation of the investment portfolio for each of the quarters ended December 2017, March 2018 and June 2018 made during the quarter/year; and the balance required to be made in the remaining quarters, RBI dictates.

“Further, with a view to building up adequate reserve to guard against market risks, henceforth, all co-operative banks shall build IFR out of realized gains on sale of investments, and subject to available net profit. All UCBs, irrespective of their DTL, shall be required to maintain IFR. All StCBs / DCCBs shall also be required to maintain IFR on similar lines, minimum threshold in which shall be computed with reference to their investment in Current category”, the letter says.