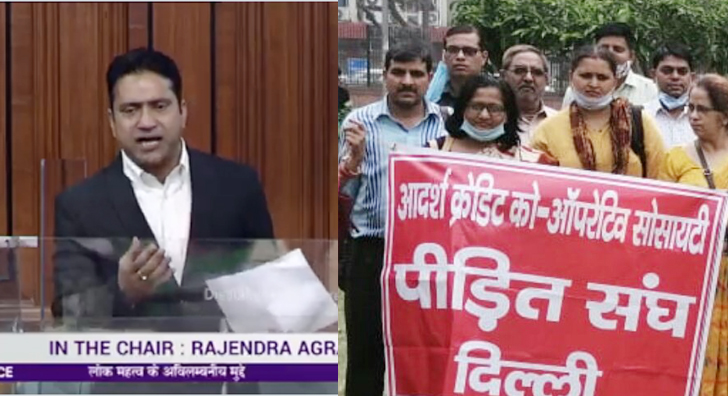

Lok Sabha MP from Churu (Rajasthan) Rahul Kaswan (BJP) raised the issue related to the beleaguered Adarsh Credit Cooperative Society during Zero Hour in the House in the Winter Session and wanted over 20 lakh gullible investors to be paid back their hard-earned money. Their money has been stuck in this society for the past many years, he said.

He said many companies have surfaced in the country with Ponzi schemes and looted the money of investors. One such company in the state is Adarsh Credit Co-operative Society, which looted investors by promising them great returns.

“The affected investors have also gone to court but to no avail. The government should ban the companies running these Ponzi schemes, he demanded.

The MP further added that the money of many farmers is also stuck in the said society. He demanded that an effective law be brought in which will benefit the investors.

Besides, Lok Sabha MP from Rashtriya Loktantrik Party Hanuman Beniwal also raised the issue of Adarsh Credit in parliament. He appealed to the government to auction the properties of the culprits and make fast-track courts to provide relief to the victims.

Replying recently to a question in Lok Sabha, Shah has informed that more than 44 multi-state co-operative societies have been wound up by the Ministry in recent times. Among others, Adarsh Credit Co-op also figured in the list.

“Complaints have been received for non – repayment of funds against some of the multi-State credit cooperative societies. In the case of delinquent societies, action for winding up is taken under Section 86 of the Multi-State Cooperative Societies (MSCS) Act, 2002’ said Shah sharing the State-wise list of such co-op societies.

Meanwhile, there are reports that recently Rajasthan High Court has ordered the liquidator to settle the matter of these investors in ninety days. Earlier, Assets worth over Rs 365 crore of Adarsh Group of companies and related firms had been attached by the Enforcement Directorate.

Beginning in Sirohi in Rajasthan, Adarsh Credit branched off to Haryana and Gujarat with its headquarters in Ahmedabad. More than seventy percent of investors are said to belong to Rajasthan.

The founder chairman of Adarsh Credit Co-op Mukesh and his family members are alleged to have run Ponzi schemes and floated several fake companies to which they diverted Rs 8400 crore. Twenty lakh people invested Rs 14,682 crore over 8 years in Adarsh credit society.