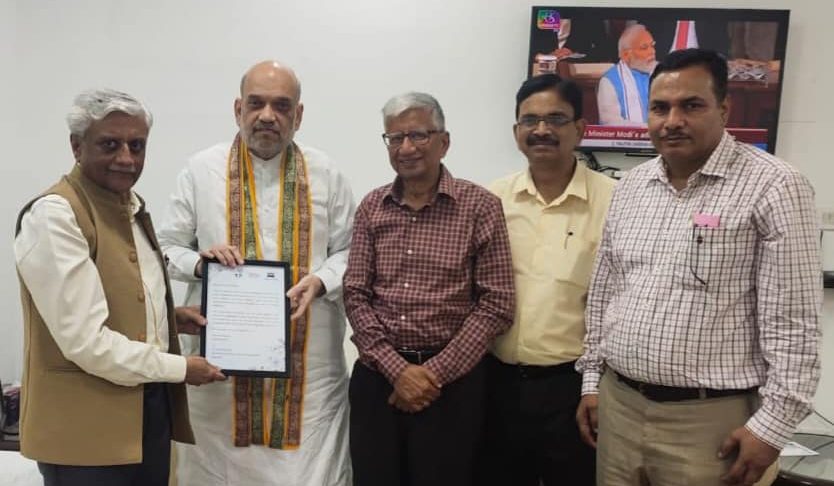

NAFCUB President Jyotindra Mehta led a delegation to meet Union Home and Cooperation Minister Amit Shah on Friday and thanked him for his contribution in resolving issues related to the Urban Cooperative Banking sector.

The meeting took place at the Parliamentary office of the Union Cooperation Minister. In his meeting with Shah, Mehta expressed gratitude on behalf of the entire cooperative sector for taking pain in resolving the long pending issues of the cooperative sector.

Soon after the meeting talking to the Indian Cooperative, Mehta said, “It was a fruitful meeting with Shah and basically the purpose of the meeting was to give thanks for the initiative taken by him in resolving the issues of UCBs”.

“The meeting lasted for more than one hour in which several discussions took place. The discussions on strengthening the PACS and providing them a platform to act as CSC were also held. Under the leadership of Shah, the cooperative sector is achieving many milestones in its development “, Mehta said.

Earlier, in his thanksgiving letter to Shah, the Nafcub President wrote, “I am at a loss for words to express gratitude on behalf of the entire cooperative sector towards you for having taken many initiatives and pains in getting some important long pending issues of the sector, addressed and sorted out by the Regulators”.

The long pending issues of the UCB sector, which have been resolved with the intervention of Shah, included, Urban Co-operative Banks (UCBs) will now be able to open new branches to expand their business, UCBs will be able to make one-time settlement of outstanding loans, like Commercial Banks, Additional time limit has been given to achieve the Priority Sector Lending (PSL) targets given to UCBs and others.

Besides, a Nodal Officer has been designated in RBI for regular interaction with UCBs. RBI has permitted UCBs to provide doorstep-banking services to their customers. RBI has more than doubled the individual housing loan limit for Rural and Urban Co-operative Banks. Rural Co-operative Banks will now be able to lend to the commercial real estate – residential housing sector, thereby diversifying their business.