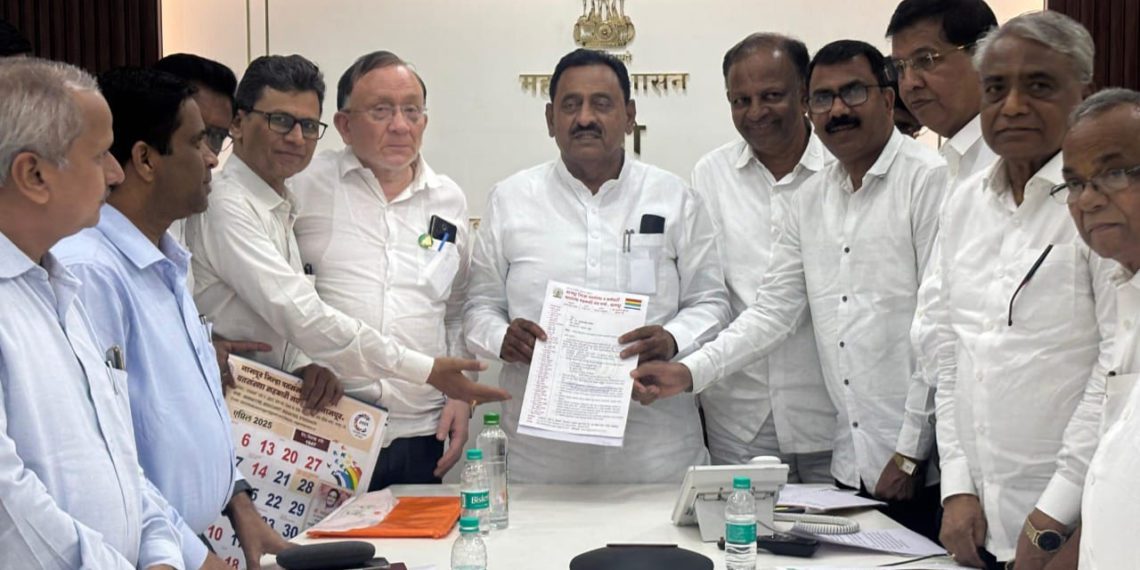

In a major development for Maharashtra’s cooperative credit sector, a high-level delegation from the Maharashtra State Cooperative Credit Societies Federation, led by its President Kaka Koyate, met with State Cooperation Minister Babasaheb Patil to highlight the ongoing challenges faced by credit societies and propose crucial reforms.

During the meeting, strong objections were raised against the controversial Deposit Protection Contribution Scheme, which has been opposed by stakeholders for the past three years.

Federation President Kaka Koyate emphasized that although six circulars had been issued over the past three years, attempting to force credit societies to contribute to the fund, not a single rupee has been collected under the scheme.

Public Health Minister Prakash Abitkar also strongly opposed the scheme, which led Cooperation Commissioner Deepak Taware to announce that the policy would be reconsidered. As a result, credit societies will no longer be compelled to contribute under the current framework—bringing much-needed relief and widespread appreciation across the sector.

Key administrative issues were also discussed. The department agreed to expedite the issuance of Form 101, related to the recovery process, as cooperative society representatives were repeatedly forced to visit the department for it. Approval of upset price proposals and swift possession of defaulters’ assets through district collectors were also promised.

A landmark reform was announced wherein cooperative credit societies will be allowed to sell seized properties within one month if defaulters fail to meet expected valuations. If the assets remain unsold, societies will be granted upset price approval based on their proposed valuation.

The Federation also requested permission for cooperative societies to construct warehouses (godowns) to support their growing role in food credit—an initiative aligned with the goal of contributing to the world’s largest food credit system.

Minister Patil called for an increase in gold loan disbursements, citing the secure and recoverable nature of such loans. He also supported the move to allow cooperative societies to sell products made by women-led Self-Help Groups (SHGs), thereby promoting grassroots economic empowerment.

In a step toward decentralization, the Federation has been authorized to create its own auditor panel to evaluate select societies and submit reports to the department for further action. The department also annulled the earlier classification of certain societies as “weak” and approved the implementation of the Federation’s Cross System across all member institutions.

Nagpur MLA Krishna Khopade raised concerns regarding corruption in the Cooperation Department, alleging demands for bribes. Minister Patil firmly assured a crackdown on such practices and committed to restoring integrity and transparency in the system.

Federation CEO Surekha Lavande welcomed the department’s decision to route government-guaranteed loans through cooperative credit societies—a move supported by Minister Abitkar to ensure better outreach at the grassroots level.

Federation Director Chandrakant Vanjari expressed gratitude to both Abitkar and Khopade for their unwavering support, which played a pivotal role in achieving these progressive outcomes.