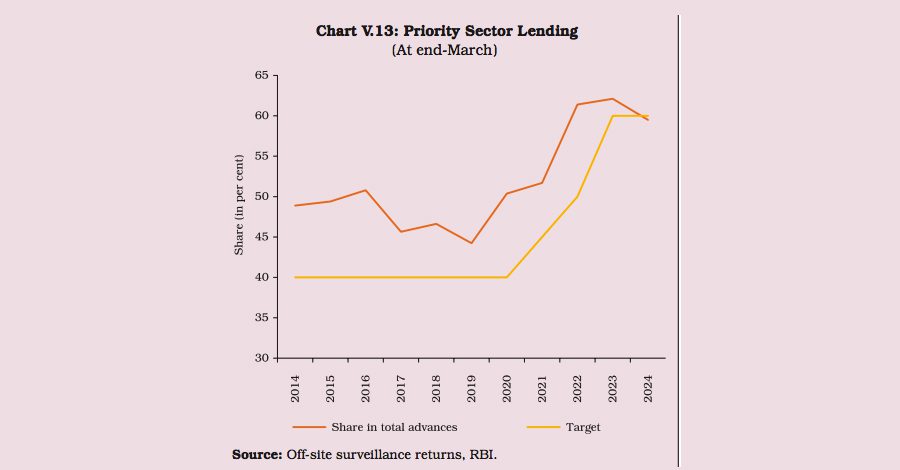

According to the RBI’s report, Urban Cooperative Banks (UCBs) missed the revised priority sector lending (PSL) target set for the end of March 2024, despite comfortably achieving the target for the previous year, i.e., March 2023.

The revised PSL guidelines mandated UCBs to achieve a phased target of 60% of their Adjusted Net Bank Credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposure (CEOBE) by March 2023 and March 2024. While the banks met this target with ease at the end of March 2023, they fell short of it in 2024.

A notable decline was observed in the share of Micro, Small, and Medium Enterprises (MSMEs), particularly small enterprises, within the total PSL during 2023-24. However, UCBs exceeded the target of 7.5% lending to micro-enterprises, demonstrating their continued focus on supporting smaller businesses within the MSME sector.

On the other hand, lending to weaker sections witnessed a decline but still met the mandated target of 11.5%. Meanwhile, the share of renewable energy in total advances showed a marginal increase, reflecting UCBs’ growing alignment with sustainable finance initiatives.

The performance of UCBs underscores both their achievements and challenges in meeting evolving regulatory benchmarks as they navigate a changing economic and policy landscape.

The shortfall in 2024 emphasizes the need for enhanced strategies to meet future targets and sustain growth in priority lending areas.