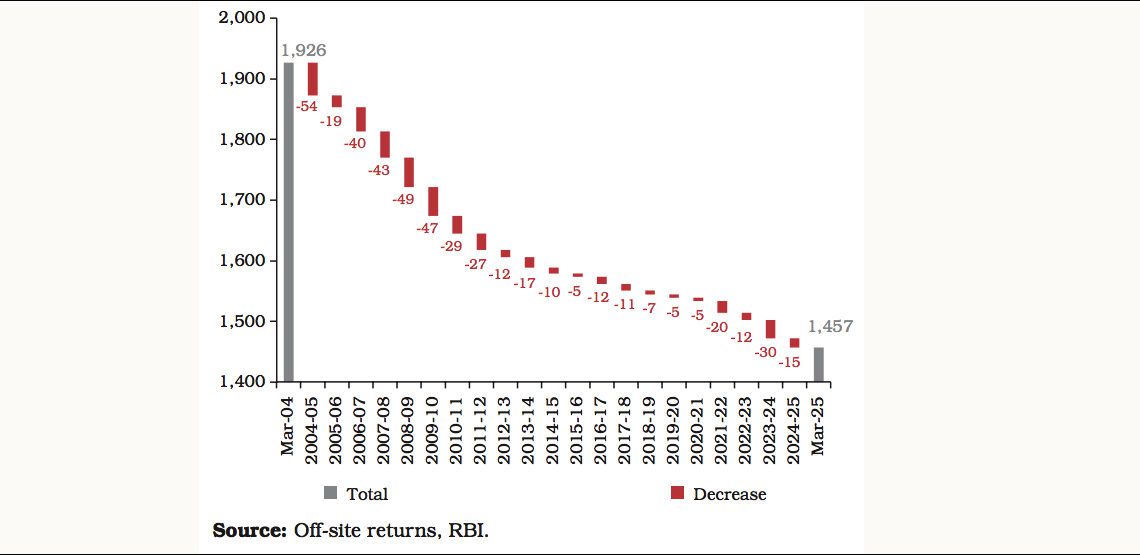

The Reserve Bank of India’s (RBI) long-running consolidation drive in the urban co-operative banking (UCB) sector, initiated in 2004-05, has led to a steady reduction in the number of banks, with the total declining from 1,926 at end-March 2004 to 1,457 at end-March 2025.

The consolidation strategy has focused on amalgamation of unviable UCBs with stronger counterparts, closure of non-viable entities and suspension of issuance of new banking licences. As part of this process, the RBI has encouraged stability and financial soundness in the sector through mergers and regulatory action.

During 2024-25, seven mergers of UCBs were affected, six in Maharashtra and one in Telangana. With these, the cumulative number of mergers since 2004-05 rose to 163, with more than half of them concentrated in Maharashtra, underscoring the state’s prominent role in the consolidation exercise.

Alongside mergers, regulatory action continued in the form of licence cancellations. In 2024-25, licences of eight non-scheduled UCBs were cancelled, two each in Uttar Pradesh and Andhra Pradesh, and one each in Bihar, Maharashtra, Assam and Tamil Nadu. This took the total number of licence cancellations since 2020-21 to 57, largely concentrated in the non-scheduled category.

The RBI’s consolidation measures aim to strengthen governance, improve resilience and protect depositors’ interests in the urban co-operative banking sector, which continues to undergo structural transformation under closer regulatory oversight.