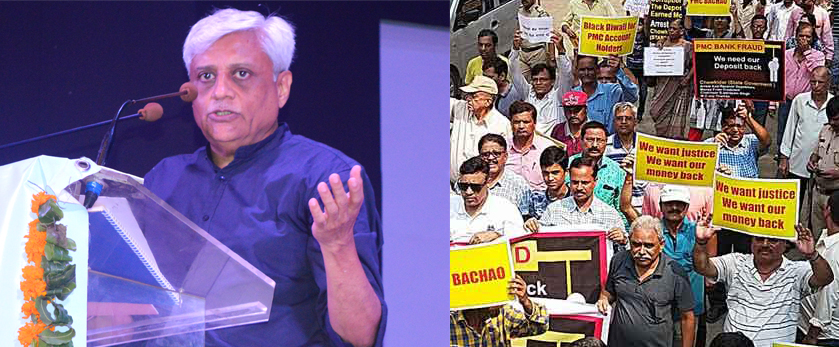

Aghast at the RBI’s move to go ahead with the PMC merger, the President of the apex body of Urban Cooperative Banks and Credit Societies of India- Nafcub Jyotindra Mehta said it is nothing less than a travesty of justice.

Mehta specifically raised three points in this connection. Why was the BR Act Amendment 2020 enacted recently if PMC’ss helpless depositors were not to be benefitted, why was the DICGC Act was not amended to suitably help them, and finally why there was no cognizance of the suggestions given to the RBI when it asked for the same from the public.

Mehta said that a core committee meeting is being organized to discuss the serious situation which has emerged due to the raw deal meted to the depositors by the RBI. “We stand with depositors with full strength as we are very well aware that UCBs will exist only till the depositors are a happy lot”, added Mehta painfully.

Elaborating, Mehta said “The Central Government amended the Banking Regulation Act with an objective to help the PMC depositors. The amendment gave RBI absolute power. But the notification released by the RBI in regard to the PMC Bank, prior to Republic Day, hardly proves this as the objective of amendment lies in tatters”, he added.

There is an urgent need to help the victims of PMC Bank by amending the Deposit Insurance and Credit Guarantee Corporation Act. According to the existing act, the DICGC gives the insured amount to the depositors of banks under liquidation. But the PMC case is queer as it

is neither this nor that. It is a case of a merger where DICGC does not intervene leaving the depositors high and dry, felt Mehta. “Govt must amend the Act to help victims of the PMC Bank”, Mehta asserted.

The NAFCUB President was also aghast at the RBI’s indifference towards those who gave suggestions on the merger. Readers would recall that when RBI came out with the draft scheme for the merger of the sick Punjab and Maharashtra Cooperative (PMC) Bank with the Unity Small Finance Bank, it asked the reactions from the public.

In this regard, thousands of people gave their reactions and voted against the scheme but the RBI took no cognizance of them and went ahead with its original plan. Indian Cooperative had also published several such suggestions given by the stakeholders.

As per the notification of the Scheme for the amalgamation of the PMC Bank, for those with more than Rs 5 lakh in deposits, the payout for the additional amount will be made in a staggered manner.

Up to Rs 50,000, the payment will be made over the next one year, for more than Rs 50 k and less than Rs 1 lakh, the payment will be made after three years. Those having deposits of more than Rs 1 lac to Rs 2.5 lac, payment will be made after four years and those above till Rs 5.5 lakh, the time frame will be more than five years, and anyone having more than this, will get payment after 10 years.

Depositors are aghast at the injustice, said Mehta