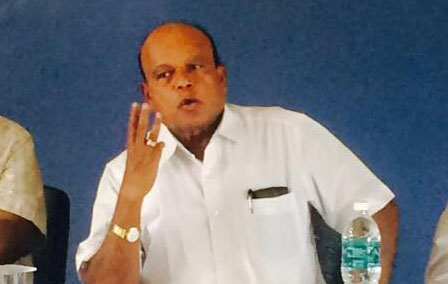

Government and RBI should give cooperative bank freedom to provide alternate delivery channels such as UPI, POS, Credit cards etc. The current RBI restriction in terms of net worth for co-operative banks should be immediately removed. Every Urban Co-operative Bank should be able to become direct members of NPCI, demanded Karnataka based UCB Manavi Pattana Sahakari Bank’s Chairman Thimmaiah Shetty.

Indian Cooperative has recently front-paged the success story of this small UCB which has been proving a boon for its members in the sleepy town of Raichur in Karnataka.

When new players such as FreeCharge and PayTM can operate in the market with negative net worth, it is unfair for the RBI to impose restrictions on co-operative banks to provide alternate delivery channels to service their customers, asks Shetty.

”We also would like to enroll at UPI with NPCI immediately, which allows our mobile banking customers to transfer funds seamlessly,” he further said to this correspondent.

Despite several problems in the wake of demonetization Manavi Pattana Sahakari Bank has been able to sell through with new strategies.

“We have already distributed Rupay debit cards to our customers with a network of 10 ATMs across our branches. We have opened several savings accounts during this period. Our bank is also active in microfinance and has helped us get more customers”, said chairman of the bank Thimmaiah Shetty.

Shetty said due to the demonetization, there is a physical shortage of cash that has affected our operations in terms of serving our customers. The cap on withdrawal from savings accounts has also affected some of our customers.

Talking about the plan for the future, he said we would like to provide around 1000 POS devices to our customers, who are traditionally traders. Unfortunately, due to scarcity of POS machines, we are unable to do so, as of now, he added.