Saraswat Bank has launched its cutting-edge Internet Banking and Mobile Banking application, GOMO NxT, aimed at enhancing digital banking services for retail individual customers. The bank has partnered with Singapore-based Tagit Pte Ltd, a leading provider of omnichannel digital banking solutions across Asia, the Middle East, and Africa.

Announcing the launch, **Saraswat Bank Chairman Gautam Thakur** said, “Saraswat Bank has always been at the forefront of adopting new-age technologies. GOMO NxT is a key step towards offering an omnichannel digital experience, delivering enhanced accessibility and a seamless user journey for our customers.”

The new platform offers a user-friendly and intuitive interface that surpasses the existing system in functionality and security. Key enhancements include bill payments, loan payments, card management, transaction limits, IPO applications, pre approved loans, mutual fund investments, and insurance applications. Retail customers can now manage their financial needs effortlessly from anywhere, at any time.

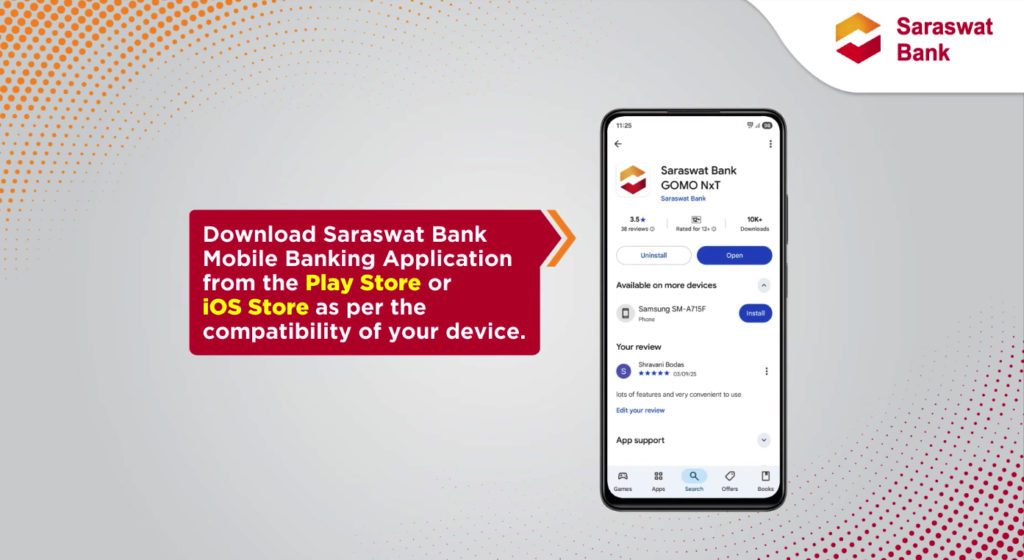

Officially launched on August 18, 2025, the GOMO NxT solution leverages Tagit’s robust Digital Banking platform, which enables the bank to deliver a comprehensive set of secure digital services while enhancing customer experience. The platform is designed to allow faster rollout of innovative services and seamless scalability as the customer base grows.

Some of the standout features of the new platform include:

Enhanced Security: Multi-factor authentication and biometric login ensure high-level security for users.

Self-Registration: Retail customers can now self-register, improving operational efficiency and reducing service turnaround time.

Omnichannel Experience: A consistent, intuitive user experience across devices encourages faster adoption of digital banking solutions.

Stable and Always-On Service: Customers are assured of a reliable banking environment with uninterrupted service availability.

With this launch, Saraswat Bank aims to strengthen its digital-first approach, addressing the growing demand for secure, feature-rich, and accessible digital banking solutions. The GOMO NxT initiative is expected to significantly enhance convenience, making it easier for customers to manage their finances while ensuring data security and operational efficiency.

This latest move reflects Saraswat Bank’s commitment to leveraging technology to create value for its customers, improve service delivery, and stay ahead in the evolving banking landscape.