A Reserve Bank of India (RBI) committee has raised concerns over a widening “AI divide” between large commercial banks and smaller cooperative financial institutions, urging targeted measures to ensure inclusive technology adoption.

The Committee on Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) in the financial sector, in its recent report, revealed that the use of Artificial Intelligence (AI) in Urban Cooperative Banks (UCBs) remains negligible.

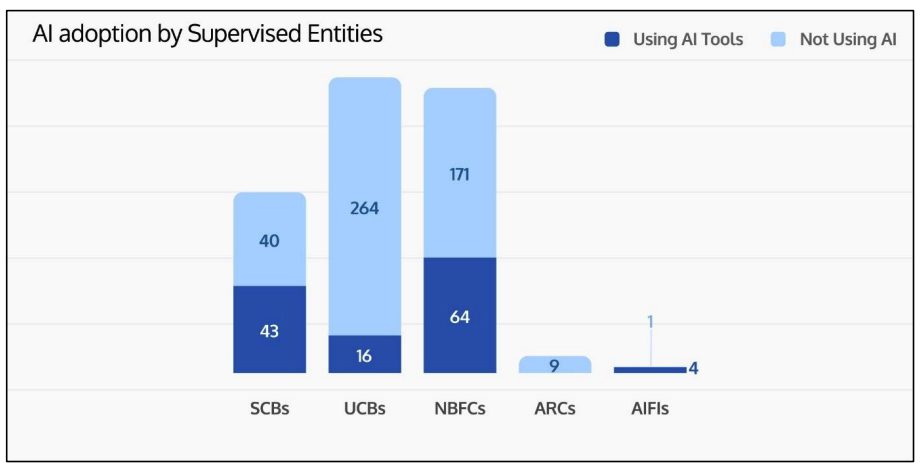

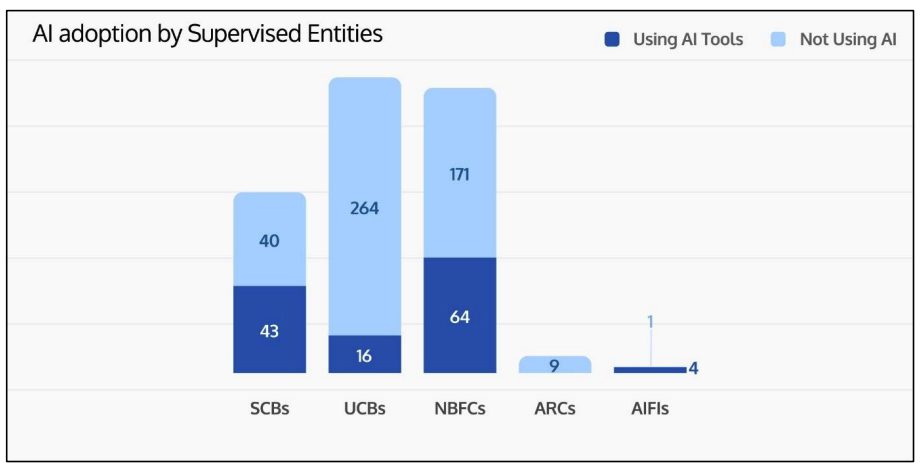

Among the 264 UCBs surveyed, only 16 reported deploying AI tools, while the rest had no adoption at all. Notably, none of the Tier 1 UCBs had implemented AI, and adoption levels in Tier 2 and Tier 3 banks were below 10%.

By contrast, larger public and private sector banks have been experimenting with AI-driven solutions for predictive analysis, customer engagement, fraud detection, and operational efficiency.

However, the committee noted that even in these institutions, AI usage is largely limited to basic functions such as chatbots, lead generation, and early-stage predictive analytics. Advanced applications remain rare.

Without intervention, the committee warned, AI adoption could become concentrated among a few well-funded entities, creating systemic imbalances and undermining the goal of financial inclusion.

To bridge this gap, the panel recommended the creation of “AI Landing Zones”, shared, plug-and-play computing environments powered by Graphics Processing Units (GPUs) and offering secure, compliant infrastructure on a pay-per-use basis. Such facilities, similar to cloud-based services provided by Indian Financial Technology and Allied Services (IFTAS), could be hosted by RBI, NABARD, or designated Umbrella Organisations for cooperatives.

These AI Landing Zones would allow smaller financial institutions to access advanced AI capabilities without bearing prohibitive infrastructure costs, thus leveling the playing field. They would also promote ethical and responsible AI deployment in compliance with regulatory standards.

The committee emphasised that equitable AI adoption is crucial for the health of India’s financial ecosystem. “It is essential to ensure that AI adoption takes place across the length and breadth of the financial sector in an inclusive, equitable, efficient, and sustainable manner,” the report stated.

The RBI panel’s proposals, if implemented, could help thousands of cooperative banks and NBFCs leapfrog into the AI era, preventing a technological divide that risks sidelining smaller players in an increasingly digital financial landscape.

Very beautiful and useful article

Many ucbs which r in the red have to b revived what measures to b taken depositors have been waiting to get back their hard earned money for more than 5vyrs. Yet no one seems to b interested in rescuing this ucb