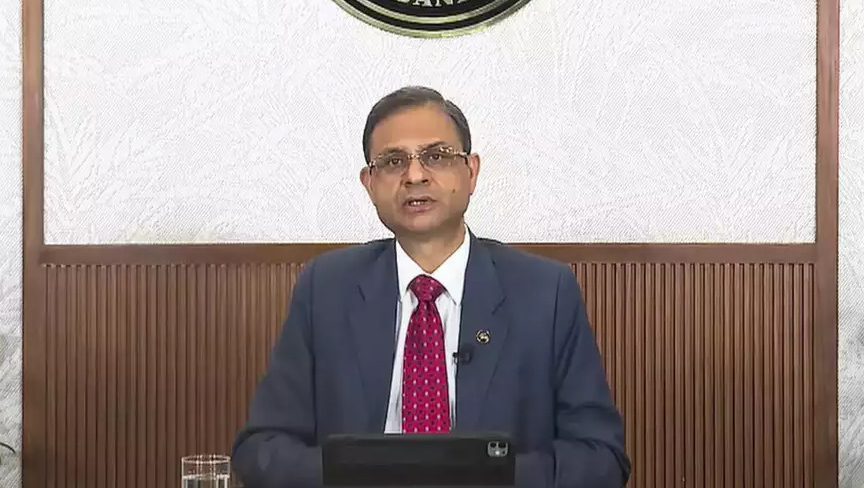

At the post-Monetary Policy Committee (MPC) press briefing on Wednesday, the Reserve Bank of India (RBI) reaffirmed the strong financial standing of the entire banking sector, with a particular emphasis on the good health of Urban Cooperative Banks (UCBs).

RBI Governor Sanjay Malhotra underscored that the sector’s capital to risk-weighted assets ratio (CRAR) continues to remain comfortably above 15 percent—a clear indication of the sector’s sound fundamentals and resilience.

Urban Cooperative Banks, often overlooked in broader financial narratives, received special mention from the Governor, who lauded their steady and consistent growth over the past two decades.

According to Malhotra, UCBs have grown at a stable rate of 8–9 percent annually, underlining their pivotal role in supporting grassroots financial inclusion and serving urban and semi-urban communities. Their performance demonstrates not only endurance but also growing relevance in India’s evolving financial ecosystem.

While acknowledging that occasional irregularities may emerge within banks, NBFCs, or cooperative institutions, Malhotra was clear in assuring that the RBI stands ready to take swift corrective action when necessary. His remarks aimed to reinforce public confidence in the health of the financial system, especially in uncertain global conditions.

The 54th MPC meeting, held from April 7 to 9, took place amid heightened global economic volatility. Trade frictions, weak crude oil prices, and corrections in equity markets have increased uncertainty, prompting divergent monetary policy responses across the world. Nevertheless, the MPC unanimously voted to cut the policy repo rate by 25 basis points to 6.00 percent and shifted its stance from ‘neutral’ to ‘accommodative’—a move aimed at nurturing economic recovery.

Despite challenges, India continues to show progress toward price stability and growth. Inflation, particularly food inflation, has eased considerably, allowing the RBI some breathing space to support economic expansion.

The economy is projected to grow at 6.5 percent in 2025–26, driven by a revival in manufacturing, resilient services, robust investment trends, and healthy rural and urban demand.

RBI also introduced several regulatory measures to enhance financial stability and inclusion. These include enabling the securitization of stressed assets, expanding co-lending frameworks, revising gold loan regulations, and increasing flexibility in the regulatory sandbox environment.

As the RBI celebrates 90 years since its establishment, it remains committed to safeguarding the integrity and stability of the financial system. The Governor’s emphasis on UCBs’ solid health served as a timely reminder of their growing importance in India’s diverse and inclusive banking landscape.