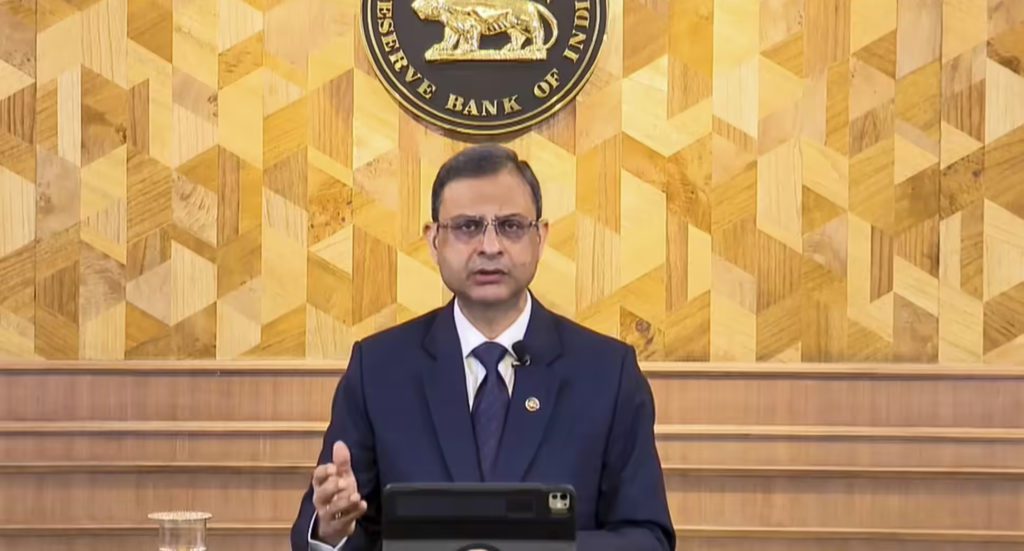

As part of the Reserve Bank of India’s continued engagement with regulated entities, the Governor, Reserve Bank of India, Sanjay Malhotra, on Monday held a high-level meeting in Mumbai with the Chairpersons and Managing Directors & Chief Executive Officers of select Urban Cooperative Banks (UCBs). The previous such interaction was held on March 19, 2025.

The meeting was attended by Deputy Governors Swaminathan J. and S. C. Murmu, along with other senior officials of the Reserve Bank of India.

Prominent UCBs represented at the meeting included Saraswat Bank (Chairman: Gautam Thakur); SVC Bank (Chairman: Durgesh Chandavarkar; CEO: Ravinder Singh); TJSB Bank (Chairman: Sharad Gangal); Cosmos Cooperative Bank (Chairman: Adv. Pralhad Kokare); Janata Sahakari Bank, Pune (Chairman: Ravindra Hejib; CEO: Jagdish Kashyap); and Bharat Co-operative Bank (Chairman: Suryakant Jaya Suvarna; CEO: Vidyanand Karkera), among others. Nearly 45 senior stakeholders from Maharashtra, Kerala, Goa and Rajasthan participated in the interaction.

Representatives from industry bodies also took part, including NAFCUB Vice-Chairman Milind Kale and NUCFDC President Jyotindra Mehta, along with CEO Prabhat Chaturvedi. The meeting lasted for nearly two hours, featuring detailed deliberations on sectoral issues.

In his address, the RBI Governor highlighted the continued relevance of UCBs in credit delivery, particularly in underserved and semi-urban areas, and their significant role in advancing financial inclusion. He referred to various policy initiatives undertaken by the Reserve Bank for the cooperative banking sector since the last interaction and expressed confidence that these measures would help UCBs grow in a stronger, healthier and more sustainable manner.

The Governor underscored the importance of maintaining high standards of governance, robust underwriting practices, and strict oversight of asset quality. He also emphasised the need for a customer-centric approach, ethical conduct, and timely grievance redressal to preserve and strengthen public trust in cooperative banks.

During the interactive session, industry representatives shared feedback on policy and operational issues. While acknowledging that UCBs are performing well overall, participants noted that profitability remains an area requiring further improvement.

Talking to Indian Cooperative, one of the participants said that issues related to the proposed ten-year directors’ tenure norms, the recent gazette notification on ineligible directors, and other pressing matters were raised during the meeting. The Reserve Bank noted the feedback but did not offer any immediate comments.

Participants further suggested the introduction of special shares without voting rights for cooperative banks to strengthen their capital base without diluting the cooperative character.

Emphasis was laid on capacity building, structured training programmes, and leadership development within UCBs. Issues related to priority sector lending, particularly lending to weaker sections, and the need for greater clarity through regulatory circulars were also discussed.

Several minor operational issues were addressed during the meeting, reflecting the regulator’s proactive and consultative engagement with the sector. Leaders also raised issues relating to the two categories of membership in cooperative banks and suggested a review of limits for small-value loans, including house repair loans. They further proposed extending the housing loan tenure beyond the current 20-year limit to better align with customer needs.

Overall, the meeting reaffirmed the Reserve Bank of India’s commitment to working closely with the UCB sector to promote better governance, enhanced transparency, and long-term stability, while ensuring that cooperative banks continue to function as vital grassroots financial institutions.