The Reserve Bank of India has extended the timeline by six months for the constitution of the Board of Management (BoM) by Urban Cooperative Banks. The timeline was to end on 31st December 2020.

The letter of RBI may have come to several urban co-op banks’ federations but it was Gujarat Federation led by Nafcub President Jyotindra Mehta who shared the news with one and all.

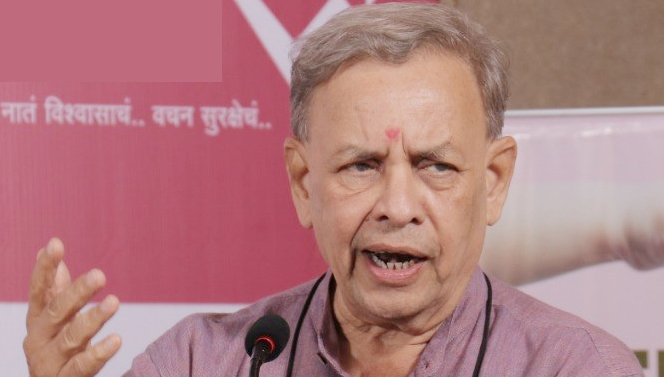

Sharing the news Nafcub President Jyotindra Mehta wrote “Dear Members, We have received positive confirmation from RBI DCBS Ahmedabad that the time limit for constitution of BOM has been extended up to 30 June 2021. A letter received in this regard from RBI Ahmedabad is forwarded for your information: Gujarat Urban Coop Banks Federation.”

The notification was signed by Rakesh Kumar Barman, General Manager, RBI which was addressed to the Chief Executive Officer, Gujarat Urban Cooperative Banks Federation.

The RBI has accepted a long-standing demand of co-operators. “This is only a temporary respite. RBI needs to revisit its guidelines in the context of the submissions made by the Co-operative Sector”, wrote senior Sahakar Bharati leader Satish Marathe on his facebook wall.

Sahakar Bharati had earlier reminded the RBI that the entire UCB sector including Sahakar Bharati, National and State Federations and Associations across the country have strongly opposed the concept as it is impractical.

With BOM being accountable to RBI, and the elected Board being accountable to Stakeholders, it is feared that two centers of decision making will emerge resulting in friction and disharmony, consequently affecting the working of UCBs, say UCB leaders.

Moreover, the need for BoM has disappeared with the UCB sector coming under total supervision of RBI after the passage of the amended

Banking Regulation Bill, they argue. “We have always believed that the Banking Regulation Act be amended to give full Regulatory powers to RBI to protect the interests of all stakeholders, particularly depositors, Sahakar Bharati leaders say.

“We firmly believe that the purpose of safeguarding the interests of Depositors will not be served by constituting BOM. Sahakar Bharati is of the firm opinion that the ultimate governance of UCBs should be fully vested with the RBI and now that it has been done there is no need for the Bom”, said Marathe.