The apex body of State Cooperative Banks and District Central Cooperative Banks-Nafscob organized its board meeting virtually on Friday in which Nabard Chairman G R Chintala was a special invitee. Besides discussion on several issues pertaining to State Co-op Banks and DCCBs, the representatives of co-op banks wanted RBI to announce yet another round of loan moratorium scheme in the wake of lockdown in different states due to Covid surge.

“There should be an expert committee to address the issues related to Co-operative Banks as was done by the RBI for Urban Cooperative Bank in February 2021”, felt several participants.

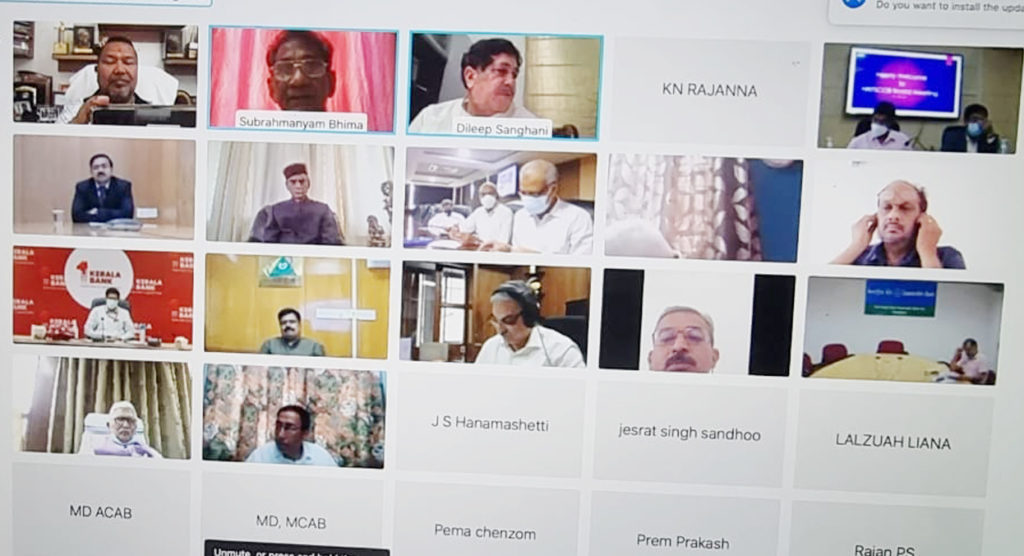

Nafscob Chairman K Ravindra Rao, Vice-Chairmen Dan Singh Rawat and Ramesh Chandra Chaubey, MD Bhima Subrahmanyam, Assam State Co-op Bank MD Dombru Saikia, Meghalaya State Co-op Bank MD Osmand E.J.Nongbri, Nagaland’s State Co-op Bank Vice-Chairman Kekhwengulo Lea and MD Abhijit Kumar Deb, Himachal Pradesh State Co-op Bank Chairman khushi Ram balnatah and former Chairman and NCUI President Dileepbhai Sanghani, among others attended the meeting.

Talking to Indian Cooperative Nafscob Vice-Chairman and Uttarakhand co-operator Dan Singh Rawat said computerization of PACCs was one of the top agendas of the discussion.

Nabard Chairman urged the representatives of State Co-op Banks to replicate the Telangana Cooperative Bank model which has almost done with the job of computerization of PACCs. It is the first state in the country to do so, Rao informed.

Reacting, Rawat added that in Uttarakhand also almost 80 percent work of the computerization of PACS is over and the remaining work will be completed sooner than later “, he claimed.

Participants in the meeting also demanded that RBI and Nabard should extend the home loan limit applicable in case of Co-op Banks. “At present State Cooperative Banks and DCCBs are allowed to give home loans only up to Rs 30 lakh and Rs 20 lakh respectively. The limit should be doubled” they demanded.

The issue of delay in the reimbursement of interest subvention amount was also taken up as participants after participants expressed the deleterious effect the delay has on the financial position of their banks. “As our money gets locked the delay causes direct loss to us”, they stressed before Nabard Chairman.

Discussion on the Banking Regulation Amendment Act was also held. NAFSCOB chairman suggested that the NABARD should come forward and conduct virtual workshops for the benefit of State cooperative bank staff members.