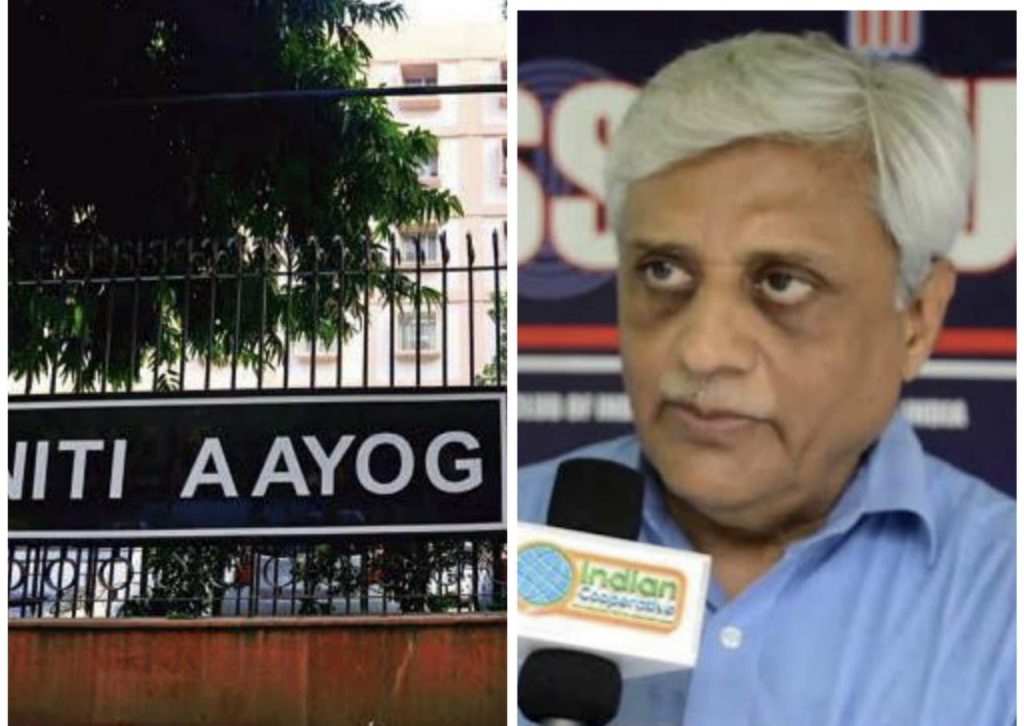

Reacting to the news in a section of the media that the Center is mulling roping in Niti Aayog for consolidating stressed urban cooperative banks, senior co-operator Jyotindra Mehta said “we have not heard anything of this kind. There is no official communication on the issue to us, ”. Mehta heads the apex national body of UCBs (Nafcub) in the country.

There is a media speculation that the Union Ministry of Finance has asked the RBI and Niti Aayog to work out modalities of merger or winding up of stressed out UCBs in the country.

According to a media estimate, out of the 1539 UCBs currently in the country, only 500 UCBs-robust and strong, would survive the Niti Aayog pruning and would be allowed to operate. It bears recalling that the Union Finance Ministry has already reduced the number of PSU Banks in the past by merging weaker ones among them.

Underlining the difference between PSU Banks and Urban Cooperative Banks, Mehta said PSU banks are owned by the government and thus it is free to run them as it wishes but the case of UCBs is different.

UCBs are member driven without a penny of the govt money involved in their ownership. UCBs follow the banking rules and regulations of the land, which allows their Board of Directors and General Bodies to run the banks to the benefit of the members. How can the government interfere in this scheme of things, asked Mehta?

As a counter question on the government forcing UCBs to merge with each other, Mehta said it is like forcing Tata, Birla or Ambani to merge. The Govt has no role in the operation of private players and in a way UCBs are private entities with control of members.

Mehta also mentioned that the Umbrella Organization, currently in the stage of finalization, has the RBI mandate of giving shelter and boosting the urban cooperative banks. The goal of UO would be to take smaller banks to the path of growth and would make big UCBs still bigger, he underlined.

“I am not against merger of weak or sick UCBs but we are certainly against forced mergers. There are routes available for voluntary merger and the UCBs be allowed to follow that”, Mehta stated.

According to a news item on the issue in the New Indian Express which quotes a source in the Finance Ministry “NITI Aayog is expected to give the first list by September this year. The process once initiated, by September there will be a list of the first slot of UCBs ready, which can be merged or privatised,”.

Pooh poohing the news item the Nafcub President said “we have not received any official communication and personally speaking I find the news item a figment of imagination. There is more shadow than substance in it”, he concluded.