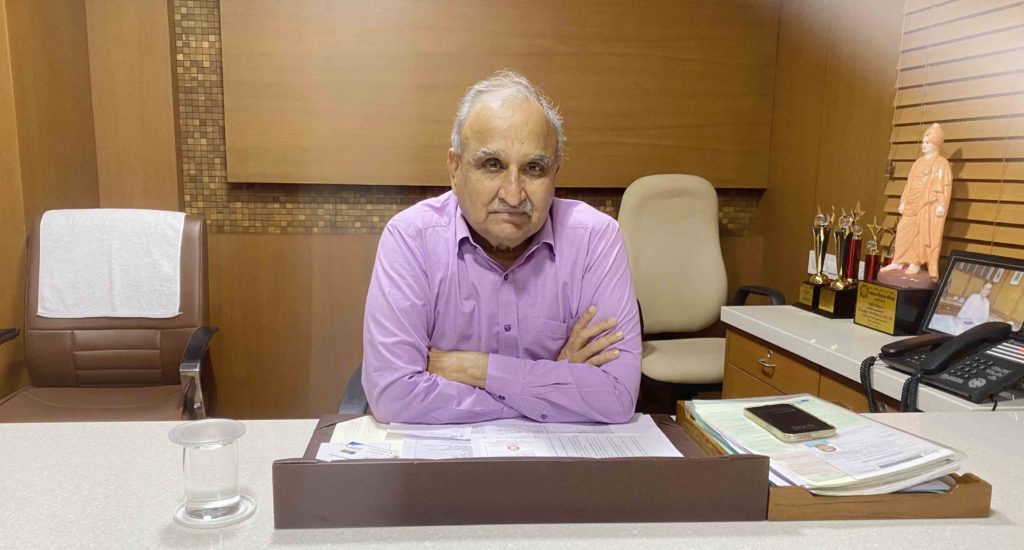

The Chairman of Gujarat’s largest UCB, Kalupur Commercial Cooperative Bank, Navnit Chimanlal Patel is opposed to the idea of reduced tenure for the Directors, as stipulated in the amended Banking Regulation Act 2020.

It bears recall that as per Section 10 (2A) (i) of the Banking Regulation Act,1949, as amended in September 2020, “No director of the banking company, other than its chairman or whole-time director by whatever name called, shall hold office continuously for a period exceeding eight years.

He also reiterated that the provisions related to the directors’ tenure should be calculated and promulgated after the notification of the new Act.

“The cooperative banks are facing problems with the eight-year tenure of directors. It is important for the bank to have people on Board who are familiar with the banking activities. Depositors park their money on the credibility of the bank as well as that of the board”, Patel added.

Talking to this correspondent at the Bank’s Ahmedabad headquarters, Patel said, “I have been on the board for 15 years and most of the directors are there for many years. The provision is a setback for UCBs as new people who join may take time in understanding the banking affairs”, he added.

“Interestingly, this provision is neither in conformity with cooperative laws nor as per the provisions of the 97th Amendment of the Constitution of India Constitution)”, argues Patel.

Sharing details about his future goals, Patel said, we are working on achieving the business mix target of Rs 20,000 crore till the end of the current financial year and around Rs 19,000 crore have been achieved so far. It’s a proud moment for us that we have come in the list of top five urban cooperative banks of India.

“The Urban Cooperative Banking sector’s future will be competitive and the UCBs will have to move on retail loans instead of wholesale. Besides, we have also contributed Rs 10 crore towards the umbrella organization for urban cooperative banks and it will help the weak banks to adopt the latest technology, among other things”, he added.

It bears recall that the Kalupur Commercial Cooperative Bank recently got Ahmedabad based Suvikas People’s Cooperative Bank merged with it. The latter had two branches.

The Kalupur Commercial Cooperative Bank’s business stood at Rs 16,988 crore and it earned a net profit of Rs 167.71 crore as on 31st March 2023.