Indian Cooperative carried out a study on the role of co-operative banks in the Mudra Yojana launched by Modi govt three years ago and was dismayed to see a dismal performance by them in the much-touted scheme.

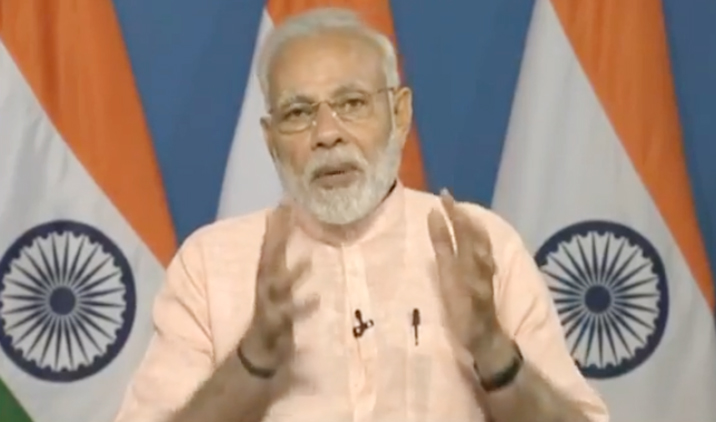

On Tuesday Prime Minister Narendra Modi interacted with large number of beneficiaries of Mudra Yojana via teleconferencing. Modi said that banks and financial institutions have given Rs 6 lakh crore to 12 crore beneficiaries, while adding that the Mudra Yojana has broken the “vicious cycle” of moneylenders and middlemen who used to control an entrepreneur’s dream.

According to report gathered by Indian Cooperative there are only 14 Urban Cooperative Banks and State Cooperative Banks that are registered under the Pradhan Mantri Mudra Yojana. It bears recall that there are more 1500 urban cooperative banks in the country and this figure of 14 co-op banks is involved in the Scheme is depressing indeed.

But even these minuscule number of UCBs have failed to participate in the Mudra Scheme. Explaining the phenomenon Sahakar Bharati Patron Satish Marathe says “All Scheduled Urban Co-op Banks are eligible to receive refinance from Mudra Bank but most of these UCBs have not availed refinance as they have low CD ratio.”

Sunil Sathe, CEO, TJSB Sahakari Bank says although, our bank has registered under the Pradhan Mantri Mudra Yojana and also disbursed loans to the entrepreneurs under this scheme but we have not claimed subsidy. We are getting satisfactory response.

Yuri Gonsalves, Vice-Chairman, Bassein Catholic Cooperative Bank feels that disbursing loan under the scheme will give rise in NPAs. “Our bank has not sanctioned loan under the Pradhan Mantri Mudra Yojana. However, we are registered but we think that disbursing loan under the scheme will give rise in NPAs” says Gonsalves.

Extolling the virtues of the Mudra Scheme Prime Minister on Tuesday said “Out of the 12 crore beneficiaries, 28 per cent or 3.25 crore are first-time entrepreneurs,”. The PM also said that 74 per cent, or 9 crore, borrowers are women and 55 per cent belong to the SC/ST and OBC category.

PM Modi said the scheme was started to promote youngsters, women, and business-minded people. “We prepared a product for those who wanted to do something,” Modi said.

Till now 12 crore loans have been approved without any guarantee and involvement of middlemen. Had Mudra Yojana been implemented a few years ago, it would have helped lakhs of people to set up their own businesses and stopped migration to a great extent, said Modi.

Prime Minister Blog says “These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.”

But alas! There is no one to tell him that co-op banks have hardly any role to play due to the long history of step-motherly treatment meted out to them by the govt of the day.

(With input from Rohit Gupta)