During the 49th Annual General Meeting of Gujarat’s largest Urban Cooperative Bank-Kalupur Commercial Cooperative Bank held on Friday in Ahmedabad, it was revealed that the Gross NPA of the UCB has increased from 1.81% to 2.94 percent. The net NPA, however, again remains zero in the financial year 2018-19.

It was also told that the Kalupur Commercial Cooperative Bank has earned a handsome net profit of Rs 122.72 crore. The UCB has performed well on fronts of deposit, loan and advances, net profit, working capital, reserves, etc.

The deposit of the bank has been increased from Rs 6,495 crore to Rs 6,939 crore registering a growth of 6.83% whereas loan and advances increased from Rs 3,903 crore to Rs 4,676 crore registering a growth of 19.81 % at the end of 2018-19 financial year.

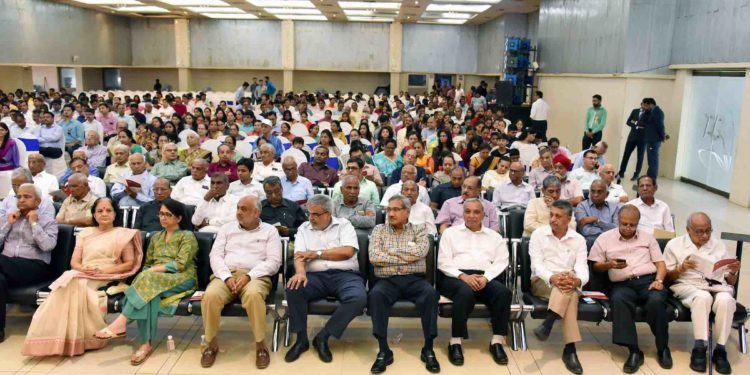

Bank’s working capital has increased from Rs 8,102 crore to Rs 8,652 crore whereas reserves increased from Rs 1,121 crore to Rs 1,244 crore, according to the financial data released during the AGM held at J.B.Auditorium in Ahmedabad.

Bank’s total business has reached to Rs 11,616.15 crore at the end of the year 2018-19.

Bank’s gross profit has been increased to Rs 713 cr as on 31.03.2019 as compared to last year total income of Rs 690 cr. After deducting total expenses, taxes and provisions from this income, bank has achieved higher Net Profit of Rs 122 cr, which was Rs 110 cr last year.

“We are pleased to inform you that our bank is entering into Golden jubilee year in December 2019. With support of all members, customers and staff members, let us celebrate this occasion with zeal and enthusiasm”, said Navnitbhai C. Patel, Chairman of the Bank on the occasion of AGM.

“The way you have contributed to the development of the UCB for the last 49 years we request you to extend the same support for the celebration of Golden Jubilee and help us achieve new milestones”, added Patel.

“We are close to our target this year and the bank has resolved to achieve a business target of Rs 13,500 crore in the current FY”, said the bank’s Chairman to this correspondent on the phone.

Kalupur Commercial Cooperative Bank has also handheld seven small, weak and sick co-operative banks in order to protect their members and depositors. Listing a few of them Patel said that Siddhi Co-operative Bank has been merged with us in April, 2019. As a result, our bank’s branch network has increased from 56 to 59 branches, Patel announced.

Kalupur Commercial Cooperative Bank will give 15 percent dividend to its shareholders.