Co-Operators across the country have welcomed the move by the RBI to revise the housing loan limit and called it a joyous moment for the cooperative banking sector. We are reproducing below the reactions given by the cooperators in this regard.

While senior leaders like Vidyadhar Anaskar welcomed the provision of giving loans to real estate projects by co-op banks, Raghavendrarao Chalasani felt UCB continues to be hampered by the lack of some provisions.

Excerpts:

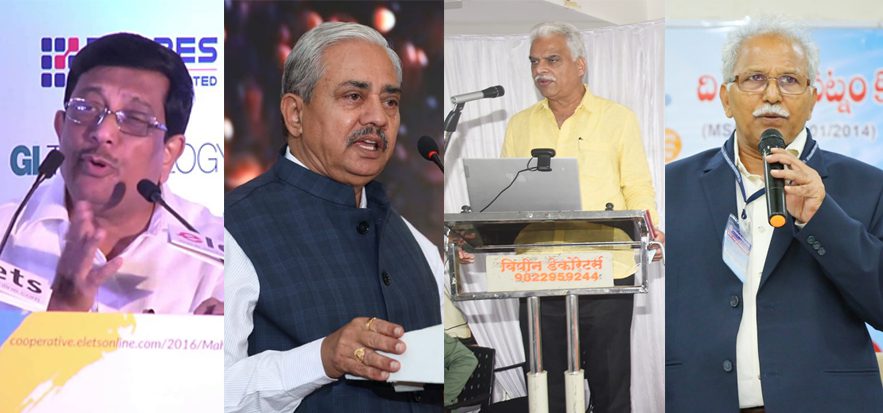

Vidyadhar Anaskar, Chairman, Maharashtra Urban Cooperative Bank Federation

For 11 years, we have been raising our voice for the revision in the housing loan limit but with the RBI notification, it seems like our dream will come true. On behalf of Maharashtra Urban Cooperative Bank Federation, we extend our thanks to FM, RBI and Ministry of Cooperation. The good thing is that we can give loans to the real estate developers to construct a housing project and there is no cut-off limit but there is a condition that the exposure to the sector is 5 percent of our total loan portfolio of STCBs and DCCBs.

Uday Joshi, National General Secretary, Sahakar Bharati

This was a longstanding demand. However, for housing project development, RBI has permitted only DCCBs & STCBs excluding UCBs. Sahkar Bharati is of the opinion to link the per party exposure for housing loans in a certain percentage of Tier 1 capital which would have facilitated UCBs in auto increase considering the Risk Appetite of every UCB.

Navneetbhai Chimnalal, Chairman, Kalupur Commercial Cooperative Bank

RBI has taken the right decision and will be helpful to the UCB sector in increasing retail housing finance, especially in big urban centers like Mumbai, Ahmedabad, etc. We hope other long pending demands like exposure norms, the cap for unsecured loans, co-lending, etc will also be considered positively by RBI and the sector will be on a growth path.

Raghavendrarao Chalasani, Chairman, Visakhapatnam Cooperative Bank

Increasing the individual borrowing limit for housing loans is a welcome move. However, unless housing loans that come under the priority sector are excluded from the overall housing and Real estate, commercial real estate ceiling of 15% of total assets of the bank, UCBs would not be able to increase their housing loans and utilize the enhanced limit.

Chandrakant Chougule, Vice-Chairman, Kaijs Bank

Due to restrictions, cooperative banks could not provide home loans in big cities and metro cities where house prices were above Rs one crore. The decision will make it possible for cooperative banks to extend home loans in big cities and metros.

Digambar Durgade, Chairman, Pune District Cooperative Bank

As far as Pune is concerned the small flat cost is more than Rs 50 lakh but with the revision of the housing loan limit, we will now attract those customers.

Shekhar Desai, Advisor, Thane Bharat Sahakari Bank

It’s a very good decision taken by the RBI however the CRE limit also needs to be increased. In order to offer the floating rate of interest product in housing loans, RBI needs to allow the extension of the repayment period of the total repayment period otherwise every time EMI needs to be changed when the link rate is changed e g Repo rate as link rate

Sekhar Kibe, Indore Paraspar Urban Cooperative Bank

It was a long pending issue, housing limit from Rs 70 Lakh to Rs 1.4 crore will be definitely useful to improve the CD ratio.

Jagmohan Taneja, former CEO, Kangra Cooperative Bank

It is a good step by the RBI. Now borrowers will turn towards coop banks for large loans. But the priority sector limit of 45 lac also should be revised to 1 Cr if not done, which is a long pending demand of Coop banks.

Shirish Deshpande, Chairman Pune Commercial coop Bank

As the rural banks have been permitted to give loans to the construction business, this will inspire the housing projects in the rural areas.

Adv Mohite Subhash, President, Pune People’s Co-op Bank Pune Maharashtra

It will help the urban banks to retain their customers who would approach commercial and public sector banks for loans of more than 30lac and 60 lacs. The permission to give doorstep services to their customers is also welcome by the sector. I hope it will really be helpful to the urban banks.

Yuri Gonsalves, Director, Bassein Catholic Cooperative Bank

It is a need of the hour and our demands have been there for many years. This will not only help in increasing the loan portfolio but also attract new customers.

Nutan Nagarik Sahakari Bank, CEO, K B Mehta

It took 10 years to revise the limit. Thank you RBI!