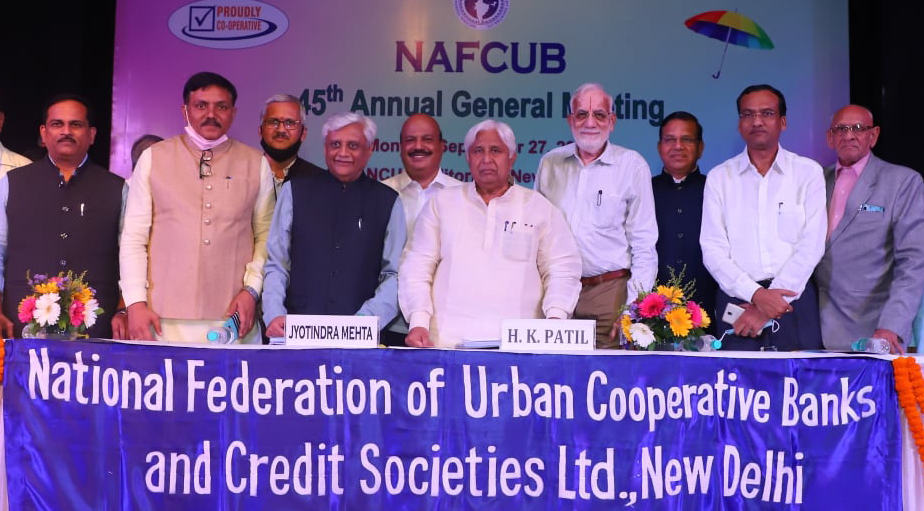

By Jyotindra Mehta, Nafcub President

Co-operative credit societies are expected to provide facilities to their members in the same way as in case of banks and so they accept deposits from members in cash and also repay deposits in cash.

Society is also required to give loans in cash to their members to fulfill immediate needs. But as per section 269SS, no person, subject to certain exceptions can accept loans or deposit of money otherwise than by account payee cheque or draft and in similar way as per section 269T of Income Tax Act. Deposit cannot be repaid otherwise than by cheques or draft. The applicability of section 269SS & 269T is not only limited to single cash transactions of Rs.20,000/- but it covers even aggregate of cash transactions which exceeds Rs.20,000/-.

The banks are exempted from Section 269SS & 269T and so banks are accepting and repaying deposits in cash. But co-op credit societies do not fall in the list of exceptions of Sec. 269SS and 269T. Co-operative credit societies are subject to control of co-operative registrar and also subject to audit by an auditor appointed by the co-operative department of the state government. KYC documents of all the members have to be obtained by the society and if the society found making mischief of accepting deposit without KYC, tax can be levied on such cash deposit u/s 68.

The intention of Section 269SS and 269T is only for the curbing practice of reflecting huge cash deposits found during search actions. So, applying sections 269SS and 269T to co-operative credit societies is not in accordance with the intention of the law.

It is therefore suggested that co-operative societies be treated at par with cooperative banks for this purpose and co-operative credit societies be added in exceptions provided in item (b) of first proviso to Section 269SS and exceptions provided in item (ii) of second proviso to Section 269T.

Co-operative Society gives loans of even more than 2 lacs to its members and repayment of loan is made by members in cash even by way of installments of less than 2 lacs and in all such situations, violation of section 269ST occurs. Cash recovery of installment loans is essential for financial activity but due to Sec. 269ST, it is difficult for the credit society to do activity of credit facility with the members.

It is worth mentioning that Co-operative banks are covered in exception in item no. (i)(b) of proviso to section 269ST of Income Tax Act but co-operative societies are not included in exceptions. So, inclusion of cooperative society along with co-operative banks should be made and remove undue hardship on credit society by treating them at par with Cooperative Banks.

Alternatively, Government may issue notification as Government is empowered by item no. (iii) of proviso to sec. 269ST and Government can exclude any class of person from the applicability of provisions of section 269ST.

Besides, in most of the cases of co-operative societies, liability of GST arises of very nominal amount on levy of service charges from members which is of meager sums. Since the cooperative societies have interest as their dominant revenue as compared to these small charges, these societies are required to charge GST only on these small charges. It is to be noted that the Interest income is classified under exempt supply by virtue of the entry no. 27 of Notification no. 12/2017- Central Tax (Rate). This notification has prescribed the list ofservicesexempted from GST.

As the interest is covered in the notification related exemption on services, no GST is required to be charged on this interest. However, since the interest is defined as a “supply” being covered under the scope of supply, the same is counted in annual turnover of the society.

Now, since Cooperative Credit societies have mainly interest income and very nominal amounts of service charges etc. from their members, they are still required to obtain GST registration as their annual turnover inclusive of such interest (which is otherwise exempt as stated above) generally exceeds the prescribed quantum of Rs. 40.00 lacs. If the societies are having only interest income below Rs. 40 lakhs, they are not liable to take registration by taking benefit of Sec. 23(1)(a) of CGST Act as it is engaged exclusively in the supply of service wholly exempted from tax.

But due to having nominal amounts of service charges from members (which are taxable) mainly in the nature of reimbursement or compensatory, societies are required to obtain registration under GST as per Sec. 22 and comply with all the requirements of filing various returns under GST Act. In case of default, heavy late fees and penalties are levied. So, it is an undue hardship to the society without any revenue to the government.

Thus, to remove this difficulty, Government may issue notification under sec. 23(2) or alternatively, Government may consider issuing notification u/s. 9(3) and including the services of Co-op. credit society in the category of taxable supply of services on which tax is to be paid) on reverse charge basis by the recipient of the service. This will relieve the societies from cumbersome GST compliances and the onus of paying GST will shift to the recipient of services whose amounts are very nominal.