Andhra Pradesh based Krishna District Cooperative Bank has done a spectacular work in the 2019-20 financial year and has registered a growth on all the financial parameters. The bank business stood at Rs 5,686 crore as on 31st March 2020 and it aims to cross the business mix by Rs 6k crore at the end of the current FY.

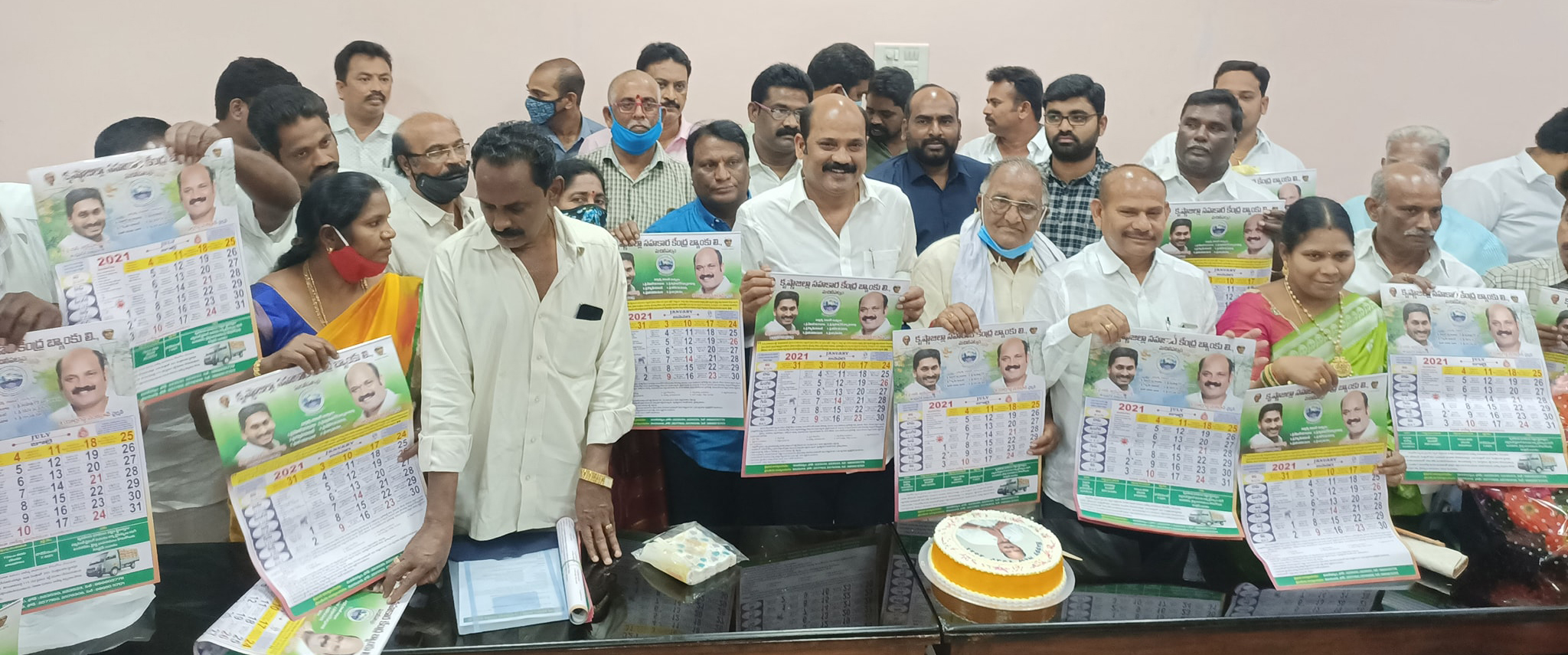

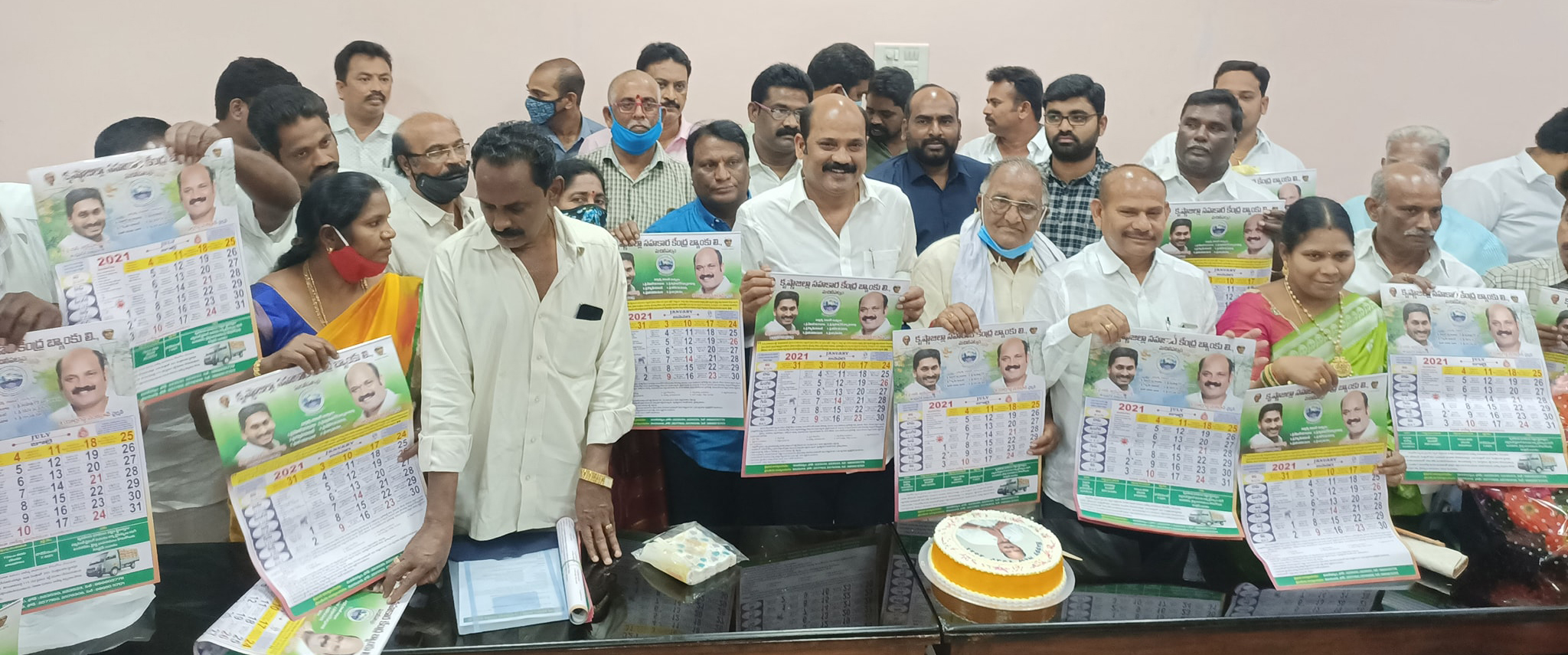

Talking to Indian Cooperative correspondent in Mumbai during the Nafscob event held recently, the bank Chairman Yarlagadda Venkata Rao said, “Registering overall growth we intend to take the co-op bank to newer heights. Specially we are focusing on the latest technology for making banking easier”, he added.

“Our total business increased from Rs 5,138 crore to Rs 5,686 crore. The bank deposits grew from Rs 1,937 crore to Rs 2,183 crore whereas loans and advances rose from Rs 3,201 crore to Rs 3,502 crore in the 2019-20 financial year. Covid-19 has affected the business of banks but we have managed things in a manner that our business is less affected”, he said in the presence of the bank CEO N. Rajaiah.

Rao further added that the bank had a Rs 1.87 crore spike in net profit as on 31st March 2020 leading to a net profit of Rs 17.47 crore from Rs 15.60 crore in the 2019-20 financial year.

The share capital of the bank increased from Rs 170 crore to Rs 192 crore and reserve grew from Rs 148 crore to Rs 160 crore in 2019-20 FY. “Our DCCB is playing a lead role among the DCCBs in providing credit support to the Rythu Mithra Groups. Krishna DCCB has more than 50% of the state’s share in RMG Finance. Out of the 425 Societies, 73PACS have recorded 100% recovery at member level during the year 2019-20”, he asserted.

The Krishna District Cooperative Bank mainly caters to the credit needs of the farmers in the district through 425 affiliated PACS besides extending direct finance through 58 Branches of the DCCB.

Earlier Krishna DCCB had given a cheque of Rs 1 lakh to the eight farmers families who had committed suicide in Vijayawada due to crop losses.

Readers would recall that recently in the overall performance category of DCCBs, Andhra Pradesh based Krishna District Cooperative Central Bank got the second prize. The bank Chairman Yarlagadda Venkata Rao, CEO N.Rajaiah and his team collected the award from the Nabard Chairman and other guests on behalf of their bank.