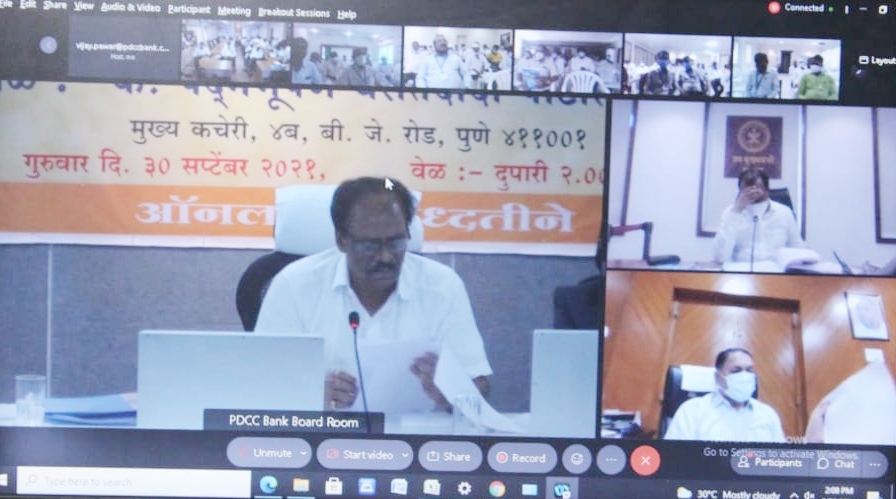

Maharashtra-based Pune District Cooperative Bank organized its 104th Annual General Meeting through video conferencing, which was attended by many VIPs including State Deputy Chief Minister Ajit Pawar and Home Minister Dilip Walse Patil. Interestingly Pawar and Patil are also on the board of the bank.

Amidst Covid-19, the bank earned a gross profit to the tune of Rs 282.51 crore in the 2020-21 financial year which is the highest ever in its 104 years of history. The bank crossed a business mix of Rs 19000 crore. The bank has decided to give an 8 percent dividend to its shareholders, announced its Chairman Ramesh Thorat.

Again, in 2020-21 the bank succeeded in maintaining ‘Zero’ net NPA.

Talking to Indian Cooperative Thorat said, “We have performed well on the financial parameters and in the interest of farmers we have announced to give a loan of Rs 5 lakh at zero rates of interest. Earlier, we were giving only Rs 3 lakh at zero ROI but now we have increased it to Rs 5 lakh. This will be a big relief for the farmers”.

“Again, in 2020-21 the bank succeeded in maintaining ‘Zero’ net NPA. The total business mix of the bank has risen from Rs 16,935 crore (2019-20 FY) to Rs 19,198 crore in the 2020-2021 FY. The deposits increased from Rs 10,097 crore to Rs 11,000 crore whereas loans and advances grew from Rs 6,848 crore to Rs 8,111 crore”, he said.

Thorat further said, “The performance is only due to the trust shown by the depositors, borrowers, account holders, farmers and well-wishers of the bank which has boosted the confidence of the Board members to achieve even better figures in future, he added.

“As of 31st March 2021, the total number of members is 10,964 out of which 9231 are cooperative societies and 1733 individual members. The bank’s authorized share capital is Rs 338.80 cr”, Thorat underlined.

The timely repayment of loans & advances by the PACs, Development societies, and farmers have been able to keep the gross as well as net NPA of the bank well within the limits set by NABARD.