In a major crackdown the special operation group of Rajasthan police arrested 11 office-bearers of the Adarsh Co-operative Society on Saturday. This practically meant most of the Mukesh family members go behind the bars.

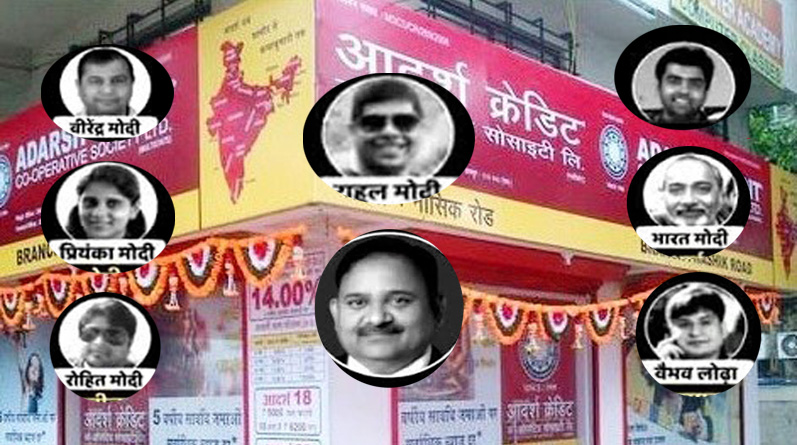

Mukesh and Rahul Modi are already behind the bars. Those arrested on Saturday by the Rajasthan police include Virendra Modi (ex-chairman of ACCSL), Priyanka Modi (ex-MD of ACCSL), Sameer Modi (CFO ACCSL), Rohit Modi (asst MD of ACCSL), Bharat Modi (director of Aditya Mega Project Pvt Ltd), Lalita Rajpurohit (Ex-MD of ACCSL), Vivek Purohit (director in six companies of ACCSL), Kamlesh Choudhary (ex-chairman of ACCSL), Ishwar Singh Sindhal (chairman of ACCSL), Vaibhav Lodha (senior vice-president of ACCSL),

Four districts namely Gurugram, Sirohi, Ahmedabad and Mumbai saw day long raids in the office and residence of those arrested later. The Director General of Police of Rajasthan, Bhupendra Singh Yadav later gave details of the raid.

“In investigation, it was also revealed that in last three years around Rs 720 crore was transferred by Mukesh Modi to a firm identified as Mahaveer Consultancies owned by Modi’s wife and son-in-law. The amount was transferred describing the owner of Mahaveer Consultancies as advisors. But when checked, it was found that no services were provided by the firm. Also and ex-gratia payment of Rs 270 core was done which is against company by-laws”, reports the HT.

It bears recall that the Modis are accused of duping more than 20 lakh depositors in the name of cooperative. The arrested founder chairman of Adarsh Credit Mukesh and his family members are alleged to have been running Ponzi schemes and had floated several fake companies to which they diverted Rs 8400 crore.

It bears recall that Modis- Mukesh and Rahul were arrested on December 10 by the Serious Fraud Investigation Office (SFIO) and were granted bail by the Delhi High Court on December 20.

While, out on the bail, Rahul Modi had held a press conference saying Adarsh Credit Cooperative Society has signed a deal with the Kolkata based realtor that would allow the society to sell all properties financed by it.

In the Adarsh Credit Co-op Society, the deposits collected by the members were used for the benefit of a few members belonging to one family and which is a clear-cut violation of cooperative principles.

Mukesh and Rahul are said to have floated several companies in the name of family members- now facing jail term- and transferred investors’ money to them. The loans were sanctioned without due diligence which indicates that the board of the society has unduly favored a few members and misused the money of the other members for personal gains.

Scores of investors regularly write to Indian Cooperative seeking help for securing their deposits from the Adarsh Credit Co-op.