In a significant step towards financial revival, Maharashtra’s prominent multi-state scheduled urban cooperative bank-Abhyudaya Co-operative Bank has reported a noteworthy turnaround for the fiscal year 2024–25.

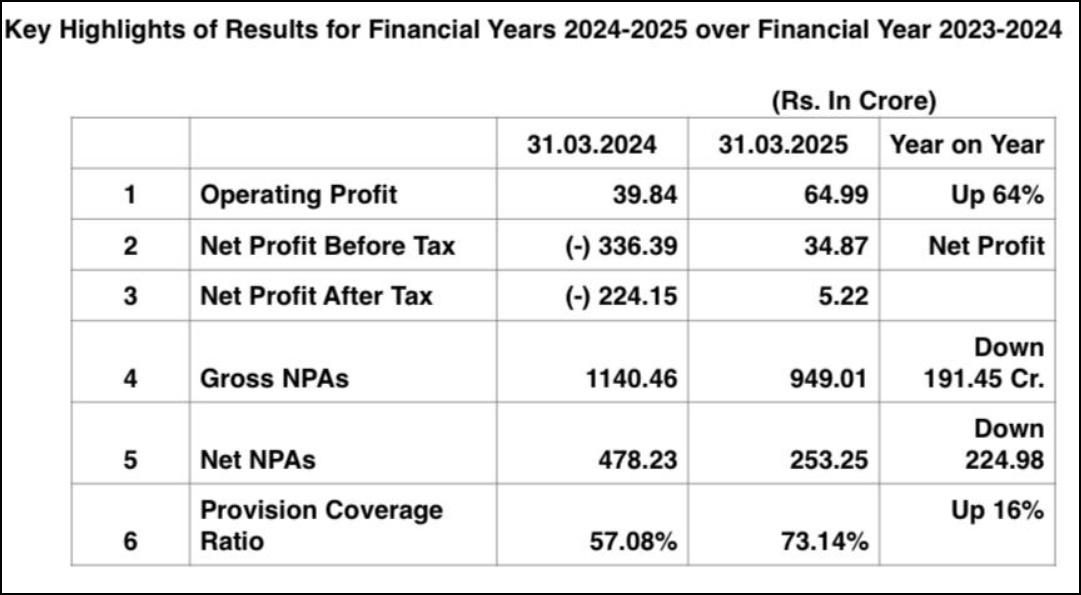

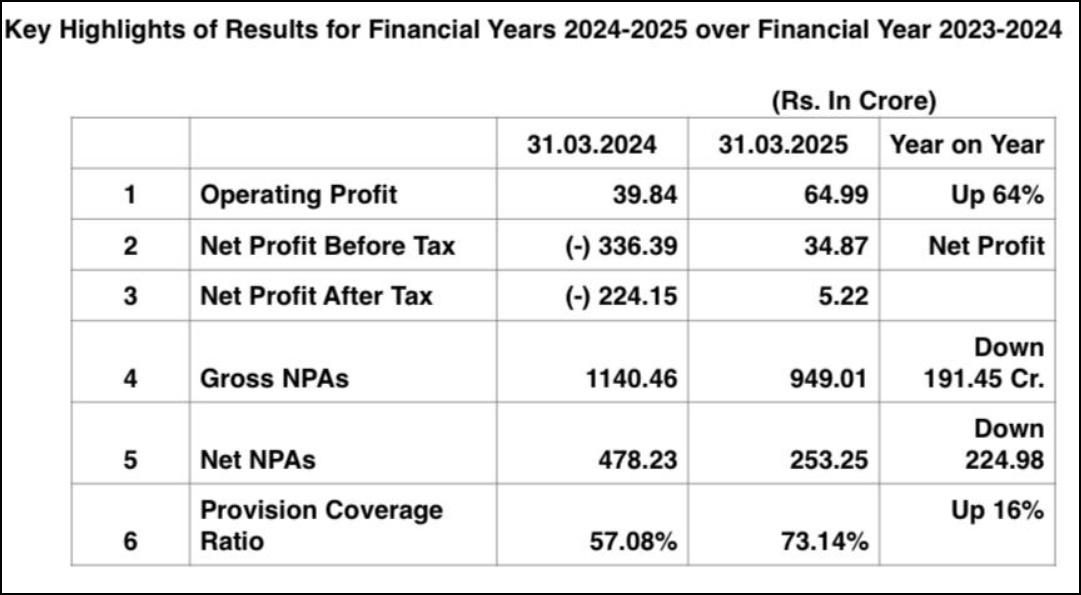

The bank registered a robust operating profit of Rs 64.99 crore, a marked improvement from Rs 39.84 crore in the previous year. It declared a gross profit of Rs 34.87 crore and a net profit of Rs 5.22 crore.

Under the leadership of RBI-appointed Administrator Satya Prakash Pathak and his advisors, the bank has not only strengthened operational performance but also made strides in reducing its long-standing accumulated losses.

Speaking to Indian Cooperative, the bank’s Interim CEO Barun R G Upadhyay expressed cautious optimism about the bank’s recovery path. “We have made collective efforts to steer the bank out of the red. While accumulated losses still remain, we are confident they will be completely wiped out in the coming years,” he said.

He further added, “We deeply value the trust our depositors have shown in us. This year’s performance gives us a strong foundation to build upon. We remain committed to transparent governance, cooperative principles, and sustained financial discipline.”

As of March 31, 2025, the bank’s accumulated losses declined to Rs 346.52 crore, down from Rs 371.50 crore the previous year, a net reduction of Rs 24.98 crore. This reduction came despite allocations from the current year’s net profit of Rs 29.64 crore towards statutory reserves and regulatory provisions, as mandated under cooperative banking norms.

The bank also witnessed significant improvement in asset quality. Gross Non-Performing Assets (NPAs) came down from Rs 1,140.46 crore to Rs 949.01 crore, while Net NPAs sharply dropped from Rs 478.23 crore to Rs 253.25 crore. The Provision Coverage Ratio (PCR) rose markedly from 57.08% to 73.14%, indicating stronger provisioning and tighter risk management.

As per the audited data, the bank’s total business stood at Rs 14,193 crore as of March 31, 2025. While deposits grew to Rs 9,327 crore from Rs 9,118 crore, the bank maintained a strong CASA ratio of 43%. Advances declined to Rs 4,866 crore from Rs 5,591 crore, primarily due to sizeable recoveries in NPAs and a deliberate reduction in large exposures to comply with RBI norms.

The bank is now focusing on retail and small SME loans, which has significantly improved the retail loan portfolio’s share over corporate/commercial lending. While deposit growth remains encouraging, the decline in advances highlights the bank’s cautious lending approach and its commitment to balance sheet cleanup, regulatory compliance, and improved asset quality.

While Abhyudaya Co-operative Bank has made notable progress in improving its financial health and operational stability during FY 2024–25, challenges still remain.

Going forward, the bank will focus on further increasing the share of retail loans, while continuing to maintain a robust core and CASA deposit base. It is also contemplating significant upgrades to its IT infrastructure and digital banking services.

Overall, the consistent improvement in profitability, asset quality, and cost control reflects a positive trajectory. With continued focus on governance, compliance, and depositor trust, the bank appears well-positioned to move toward sustained recovery and long-term growth.