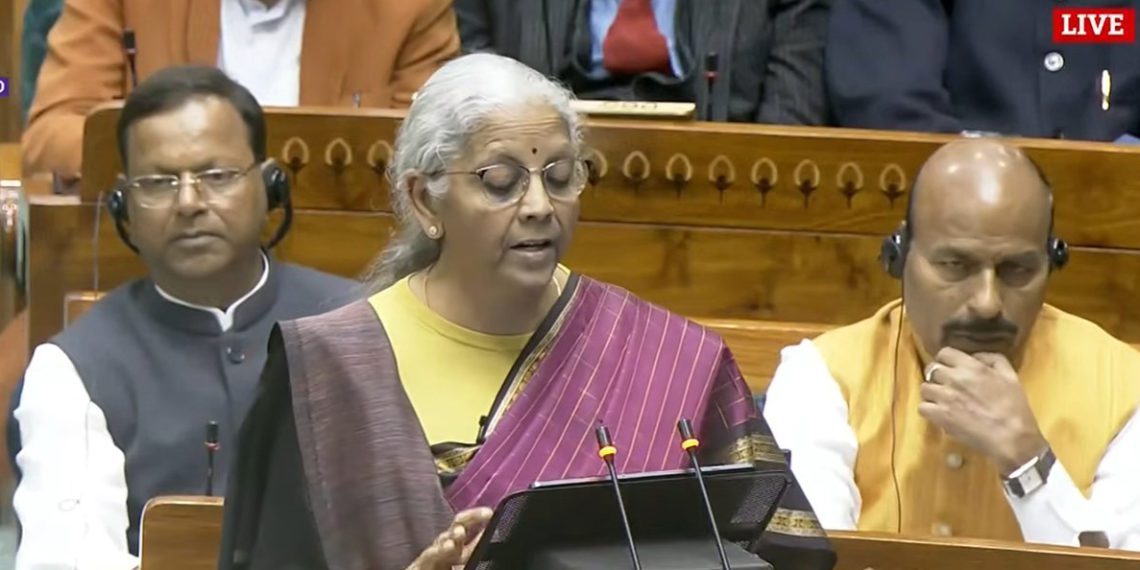

The Union Finance Minister Nirmala Sitharaman, while presenting the Union Budget on Sunday, announced the setting up of a High-Level Committee on Banking for Viksit Bharat to comprehensively review the banking sector and align it with India’s next phase of economic growth.

While no specific categories were mentioned, the scope of “banking” is expected to cover the entire banking ecosystem, including cooperative banks and regional rural banks.

Highlighting the sector’s strong fundamentals, the Finance Minister noted that the Indian banking system today is marked by robust balance sheets, record-high profitability, improved asset quality, and banking coverage across more than 98 percent of villages. At this critical juncture, she said, a forward-looking evaluation is essential to sustain reform-led growth.

The proposed committee will examine structural and regulatory aspects of the banking sector and recommend measures to strengthen financial stability, deepen financial inclusion, and enhance consumer protection, while supporting India’s long-term development goals under the Viksit Bharat vision.

As part of broader financial sector reforms, the Finance Minister also outlined a clear vision for NBFCs, with defined targets for credit expansion and technology adoption. To improve scale and efficiency in public sector NBFCs, she proposed the restructuring of Power Finance Corporation (PFC) and Rural Electrification Corporation (REC).

Additionally, a comprehensive review of Foreign Exchange Management (Non-Debt Instruments) Rules was announced to make foreign investment regulations more contemporary and user-friendly.