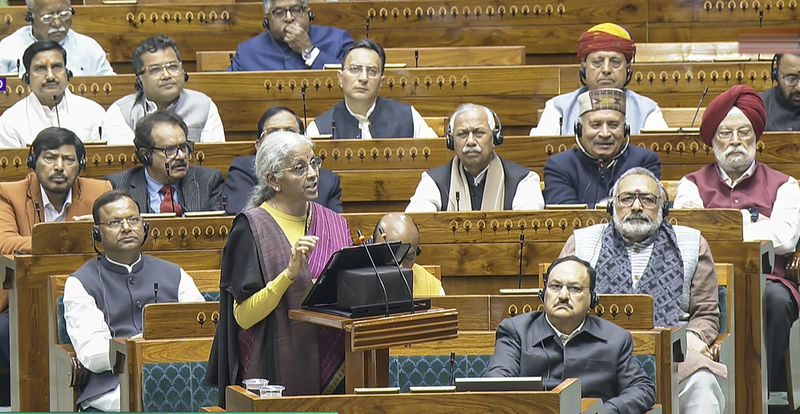

The Union Budget 2026 has delivered a major relief package for the cooperative sector, with Union Finance Minister Nirmala Sitharaman announcing a series of targeted tax incentives aimed at strengthening primary cooperatives, inter-cooperative institutions, and national cooperative federations.

The measures, unveiled in the Lok Sabha on Sunday, are expected to enhance financial sustainability, improve liquidity, and prevent double taxation within the cooperative framework.

As part of the proposals, the government has extended the existing income tax deduction available to primary cooperative societies. Until now, this benefit applied to cooperatives engaged in supplying milk, oilseeds, fruits, or vegetables raised or grown by their members.

The Budget proposes to widen the scope of this deduction to also include primary cooperatives supplying cattle feed and cotton seed produced by their members. The deduction will apply when such supplies are made to federal cooperatives, government organisations, and other eligible entities, providing additional support to cooperatives linked to allied agricultural activities.

Addressing concerns related to taxation of surplus distribution, the Finance Minister proposed a key reform under the new tax regime. Dividend income received by one cooperative society from another cooperative society will now be allowed as a deduction, provided the amount is further distributed to members.

While this deduction was available under the old tax regime, its absence under the new regime led to the risk of double taxation, first at the cooperative level and again in the hands of members. The proposed change aims to ensure tax neutrality and fairness.

In another significant announcement, the Budget provides a three-year exemption on dividend income received by a notified national cooperative federation from investments made in companies up to January 31, 2026.

This exemption will be available only to the extent that such dividend income is subsequently distributed to member cooperatives, ensuring that the benefit reaches the wider cooperative network.

Overall, these Budget 2026 proposals reaffirm the government’s commitment to strengthening the cooperative sector by easing tax burdens, encouraging member-centric surplus distribution, and supporting cooperatives as key drivers of rural development and inclusive growth.